Since taking office as Argentina’s president in December 2023, Javier Milei has done something remarkable. He has reduced the annual inflation from 211 percent to 33.5 percent and balanced the budget for the first time in over a decade. His unexpectedly strong victory in Sunday’s midterm elections appears to validate his approach domestically, with US Treasury Secretary Scott Bessent’s announcement of financial support signaling international confidence as well. Yet Argentina finds itself in familiar territory: economic instability, a volatile currency, and persistent uncertainty.

The continuing chaos suggests that Argentina’s troubles run deeper than mere policy mistakes, and it remains unclear whether the recent electoral results will alleviate the exchange rate volatility. While US Treasury involvement in the Argentine exchange rate market buys time, it is not the solution to the underlying problems.

Argentines do not trust the government. Milei’s reforms are a step in the right direction, to be sure. But, after decades of Peronism and partial reversals, those reforms are not enough to restore trust. They are better policies now, but they are not credible commitments to better policies in the future. History has taught Argentines to be skeptical of broad-sweeping reforms, because such reforms do not usually last.

There are only two paths forward for Argentina. Argentina’s politicians could completely change how they operate, commit to deeper structural reforms, and rebuild trust over the years (and perhaps decades) to come. We might call that the long road. Alternatively, Argentina could take a shortcut. By adopting the dollar, Argentina’s current politicians would constrain future politicians from engaging in the cycle of deficits, debt, and debasement that has plagued the country for so long. The experience of dollarized countries, such as Ecuador, show that dollarization mitigates the macroeconomic cost of populist policies. Correspondingly, dollarization would make the current reforms credible and restore trust in the government.

When Good Policies Aren’t Good Enough

Milei’s economic strategy is to reduce government spending and slow the growth rate of money. Both approaches show technical progress, but lack the credibility needed for lasting success.

The Fiscal Problem

Milei’s now-famous “chainsaw” approach to budget cuts worked brilliantly as political theater. Unfortunately, it lacks the staying power that deeper structural reforms would provide. Future governments can easily reverse the cuts, turning the spending faucet back on.

Let’s start with the supposed deficit reductions. Argentina is issuing bonds that capitalize interest payments rather than paying them as coupons. These delayed payments don’t appear in monthly budget reports, making the government’s finances look better than they actually are. Indeed, the accumulated unpaid interest — currently estimated at two percent of the country’s total economic output and growing faster than the economy itself — amounts to a debt time bomb. Unless something changes, Argentina will eventually be forced to default on those bonds or monetize them. (Sound familiar?)

Peso-denominated debt is extremely fragile. Argentina cannot indefinitely refinance debt in a currency that few people want to hold.

Meanwhile, the hard work remains undone. Essential reforms to labor laws, tax systems, welfare programs, and trade policies are still pending. Without these foundational changes, balanced budgets remain just one election away from collapse.

The Money Supply Mirage and the Exchange Rate Problem

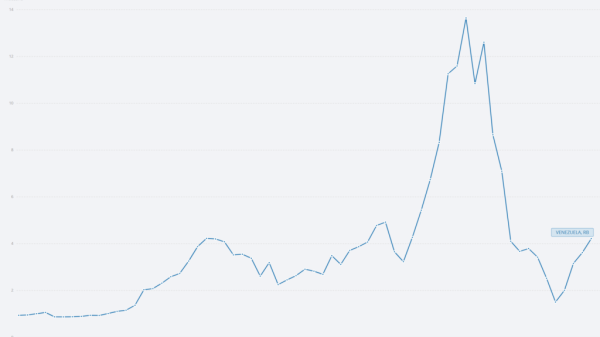

Next, consider the supposed monetary progress. In December 2023, Argentina increased its official exchange rate from 366.4 to 800 pesos per US dollar. It also committed to a 2-percent monthly devaluation target, which would further reduce the value of the peso by about 27 percent per year going forward.

In fact, the government began missing its target almost immediately. By mid-2024, the amount of pesos in circulation had expanded by 54 percent, vastly exceeding reasonable estimates of the growth in peso demand. Rather than raising interest rates to tighten monetary policy, the government cut rates, undermining its plan to gradually devalue the peso by two percent per month. Once again, Argentina’s attempt to control inflation through exchange rate manipulation proved unsustainable.

Reality eventually forced the government into damage control mode. It rolled out Phase 2 of the economic plan in mid-2024, which aimed to reset expectations through a new promise to tighten monetary policy. The government initially reaffirmed its commitment to devaluing the peso at two percent, and then revised the promised devaluation rate down to one percent per month in January 2025. Meanwhile, inflation continued running above one percent per month.

In mid-2025, the government rolled out Phase 3, which established a flexible exchange rate regime, eliminated capital controls, and included assistance from the International Monetary Fund. But currency pressure has persisted. The exchange rate, which stood at 1,073 pesos per US dollar at the beginning of April 2025, is now around 1,400 pesos — well above the rate consistent with the two-percent devaluation projected back in Phase 1.

The numbers tell the story. Following the currency devaluation in December 2023, the peso has weakened by 63 percent and prices have risen by 155 percent. Now Phase 3 faces its own crisis, as the exchange rate tests the limits of the government’s target range. The US Treasury stepping in with a $20 billion swap line allowed Milei to stabilize the currency situation before the elections, and his strong electoral performance has provided a temporary boost to market confidence. Milei should now use his renewed political power to push forward the much-needed changes to Argentina’s government. In so doing, he would end the unhelpful uncertainty and speculation over the long-run sustainability of his reform agenda.

Is Milei His Own Worst Enemy?

Financial markets cannot ignore the crucial role President Milei himself has played in worsening the credibility crisis. He engages in unnecessary confrontations and unhelpful political polarization. His relentless public attacks on journalists, business leaders, provincial governors, and potential allies have created political uncertainty that investors punish with demands for higher returns. Building credibility requires more than sound fiscal numbers; it demands institutional predictability and coalition-building.

Milei’s inflammatory rhetoric and sudden policy shifts make him an additional source of instability in an already fragile economy. While his midterm electoral victory demonstrated continued public support for his reforms, the question remains whether his strengthened political position will be used to build consensus or to further entrench divisive tactics.

Yet the credibility crisis is not limited to Milei. It extends to Argentina’s entire political class.

In a democracy, Congress controls spending while the president implements the budget. No matter Milei’s intentions, a fiscally irresponsible Congress creates uncertainty about the country’s financial future. Even with his improved electoral mandate, Milei’s team has spent more energy antagonizing legislators than building partnerships, deepening doubts about what happens when Congress reasserts budget control. Breaking free requires a credibility shock that transcends the current government. Otherwise, Argentine economic policy will continue to lurch from temporary fix to temporary fix instead of building lasting solutions.

Sustainable Reforms Require Credibility

Balanced budgets and monetary stability are necessary for sustainable growth. But they are not sufficient. Without credibility, even successful reforms won’t generate the confidence needed for lasting economic progress.

Argentina can’t afford another round of promising reforms that ultimately fail due to the understandable lack of trust Argentines have in their government. The government must acknowledge an uncomfortable truth: in Argentina, economic success requires not just sound policies but also the political credibility to sustain them. Milei’s electoral victory and international support from the US Treasury provide a window of opportunity. But elections can go either way. Like the September Buenos Aires province elections, where Milei suffered a terrible defeat, Argentina may be only one election away from renewed left-wing populism. Until the fundamental credibility challenge is addressed, the country will remain stuck between technical competence and market confidence, a gap that no amount of fiscal discipline alone can bridge.