On May 22, Donald Trump celebrated the House’s passage of HR1 , proclaiming

THE ONE, BIG, BEAUTIFUL BILL has PASSED the House of Representatives! This is arguably the most significant piece of Legislation that will ever be signed in the History of our Country!

Incredibly, the actual formal name of the bill, in the legislation itself, is “The One Big Beautiful Bill” Act. Unsurprisingly, the bill is now often called the “OBBBA.”

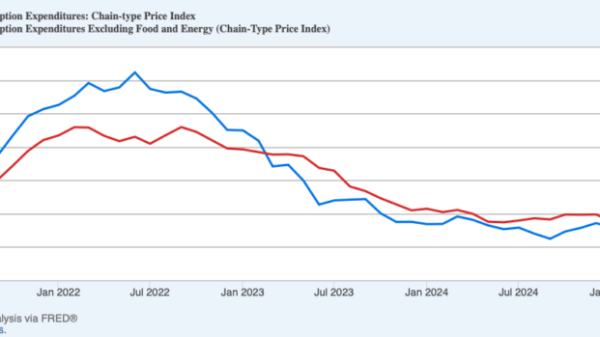

It’s hard to know if “Big Beautiful Bill,” a vague description with a positive valence, is better or worse than the “Inflation Reduction Act,” which was cynically named to be the opposite of its intended and obvious effects. While the bill is big, the question of whether it is beautiful is more contentious.

There are many things that might be said about the OBBBA. Given the problems of D.A.F.T. policy, this bill seems irresponsible. As David Hebert recently said, a focus on spending cuts, even if they were real, cannot be enough. It will take real spending cuts to solve the deficit problem, and OBBBA definitely does not come close to cutting spending.

I want to look at a different part of the OBBBA, the proposal to expand the state-and-local tax (“SALT”) deductions. Here is what the House version of the Bill actually says about SALT:

[Internal Revenue Code sec. 275] is amended so that no individual deduction shall be allowed for…any specified taxes that exceed—

(I) $20,200, for married filing separately, or

(II) $40,400, for any other taxpayer

There are some details that involve a reduction in these caps for taxpayers with incomes much over $500,000, and also indexing the caps for inflation, but the above captures the gist of the proposed change.

In broad terms, the mechanics of SALT deductions work like business expenses, and in fact deducting taxes from profits makes sense for businesses. But allowing the deduction of tax payments for individuals is actually quite a different matter, because instead of subsidizing people the deductions subsidize states, in effect rewarding those states that impose excessive tax burdens on their citizens.

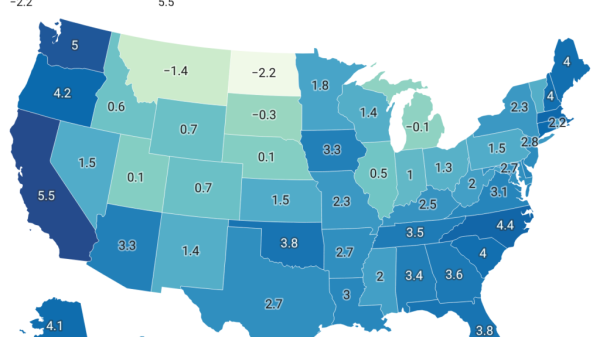

Consider the jurisdictions where the SALT deduction has the biggest impact: California, Connecticut, District of Columbia, Maryland, Massachusetts, New Jersey, and New York. Biggest impact means that these states either have both a high proportion of itemizers and large average SALT deductions (and probably both).

To give a basis for comparison, let’s look at the top “big tax” states, which are listed in the following table.

Top 10 States by Income Tax Rates and Corresponding Sales Tax

RankStateIncome Tax (Top Marginal)Sales Tax (Avg Combined)1New York14.78%8.875%2Oregon14.69%(no sales tax)3California14.40%~8.85%4New Jersey11.75%6.625%5Hawaii11.00%4.5%6Minnesota9.85%~8.375%7Massachusetts9.00%6.25%8Maryland8.95%6%9Vermont8.75%~7%10Maine7.15%5.5%

Now, we live in a “federal” system, meaning that the tax and regulatory policies of states are disciplined by the ability of citizens to “exit” if a state tries to take, or control, too much. The highlighted states had net out-migration of US citizens (though not always of foreign immigrants) over the period 2010-2020. Tax policy is not the only reason, but it is a factor.

The problem is that the SALT deduction substantially mitigates the incentives states have to adopt responsible tax policies. In fact, SALT imposes a “cross-subsidy,” where the low-tax states have to make up the difference in tax revenues at the federal level. Consider an example: Suppose State A has a 12 percent income tax, State B has no income tax. Citizens in both states pay 30 percent (in our example) federal income taxes.

Take, for example, a household earning $100k per year in each state. The citizen of B pays $30k in federal income taxes, and no state income taxes.

But the citizen of A pays $12k in state income taxes, and that tax is deducted from their taxable income! As a result, the citizen of state A pays only $26.4k of federal income tax.

In effect, the citizens of B are being forced to pay extra federal tax, to make up for the profligacy of the state government of A, a state where citizens of B have no vote, and may never even have visited!

Worse, the SALT deduction benefits only the very highest earners, and those who itemize their deductions, leaving out the many poorer citizens who might benefit from the deduction. According to the Tax Policy Center, more than 90 percent of the benefits of the uncapped SALT deduction went to households earning over $100,000.

The states that benefit most from SALT deductions, and which would benefit most from the OBBBA amendments to the policy, have acted badly and are only getting worse. David Ditch, an analyst at EPIC, notes that California, perhaps the worst overall offender, has chosen a path that cannot be sustained, or justified. In 2000, California’s state budget was already 26 percent larger than the combined budgets of Texas and Florida, despite those two states having three million more residents.

Since then, the population gap has widened: Texas and Florida now have 15 million more people than California. Yet California’s budget has grown to be 81 percent larger than the combined budgets of those two faster-growing states.

California, all by itself, shows the consequences of how badly SALT deductions work to constrain poor tax policy. It is plausible to conjecture that a substantial part of the reason that Florida and Texas are growing faster is that they have more sensible tax policies.

One can be a fan of state’s rights, and the ability of state governments to have different tax and spending regimes, since citizens are free to move among states and choose the configuration that they want. But the proposed OBBBA amendments go in the wrong direction, quadrupling the SALT deduction. The result would be that citizens in Texas and California will pay substantially higher federal tax rates than Californians, and for no reason other than the fact that Californians are being protected from the full consequences of their irresponsible policy choices.