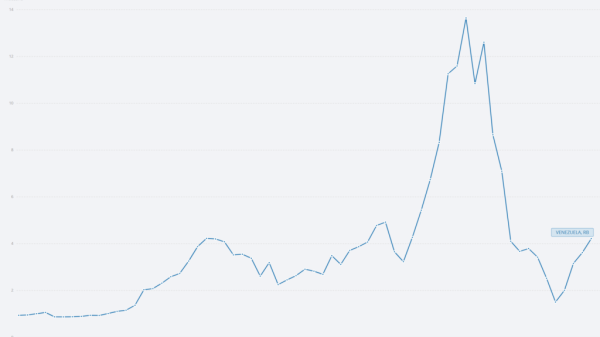

Inflation ticked up in October. The Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose 0.2 percent last month. Prices are up 2.6 percent over the last twelve months, slightly higher than the 2.4 percent growth realized over the twelve-month period ending in September.

Core inflation, which excludes volatile food and energy prices, is even higher. It rose 0.3 percent in October and 3.3 percent over the last twelve months.

The largest contributor to CPI growth was shelter, which rose 0.4 percent last month. The shelter component accounts for roughly one third of the CPI basket and nearly one half of the core CPI basket. BLS attributes “over half of the monthly all items increase” to rising shelter prices.Considering that the current above-target inflation rate is largely driven by the shelter component, there is little cause for concern. We know that estimated shelter prices are a lagging indicator of inflationary pressure. The shelter component grew slower than the overall index in 2021, when the inflationary surge began. Now it is gaining. Once estimated shelter prices catch up, however, they will return to a more normal growth path. As that happens, headline and core CPI inflation will moderate further.

Moreover, monetary policy remains tight. The Federal Reserve reduced its federal funds rate target range to 4.50 to 4.75 percent earlier this month. If consumer prices were to continue to grow at an annualized rate of 2.9 percent, as they did in October, the real (i.e., inflation-adjusted) federal funds rate target range would be 1.6 to 1.85 percent. That range is higher than conventional estimates of the natural rate of interest. For example, the New York Fed puts the natural rate somewhere between 0.74 and 1.22 percent in Q2:2024. Hence, even after an uptick in inflation and reductions in the interest rate target, market rates still exceed the natural rate. It doesn’t look like we’ve inadvertently stumbled back into loose-money territory.

We get the same picture from money supply data. M2 is growing at just shy of 2.5 percent per year. The broader liquidity-weighted aggregates are up between 2.32 and 2.67 percent over the same period. Historically, those money growth rates would be considered pretty slow. Indeed, money supply growth is likely not keeping up with money demand, which can be estimated by adding real economic growth to population growth. Real gross domestic product grew at an annualized rate of 2.65 percent in Q3:2024. The US population grew 0.5 percent in 2023, the most recent year for which the Census Bureau has data. Hence, money demand is growing at approximately 3.15 percent per year. As with interest rates, money growth data suggests monetary policy is still somewhat tight.

The Fed’s recent monetary loosening appears defensible. We shouldn’t read too much into a one-month inflation blip. That said, it would be prudent for the Fed to pause its monetary easing. Monetary policy looks tight judging by interest rates and money supply data, but closer to neutral than it has been. The FOMC next meets December 17-18. It’s always possible new data will change how we evaluate the economy, but provided the next PCEPI release corresponds to what we’ve just learned from the CPI, it’s probably best to hold policy steady for a few months.