Cryptocurrencies maintain a bullish stance as Bitcoin showcases upside momentum above the $100K mark.

BTC changed hands at $101,830 during this publication, and magnified investor optimism suggests more gains.

Its upside stance has triggered substantial movements in the altcoins space, with Hedera and Worldcoin stealing the show.

Investor optimism drives BTC recovery

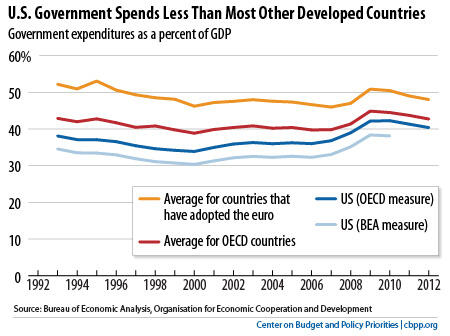

Increased interest from United States investors drives BTC’s ongoing recovery.

For instance, MicroStrategy has added its Bitcoin holdings for nine consecutive weeks.

The firm now holds a whopping 447,470 BTC, establishing itself as a top player in the cryptocurrency industry.

📈 MicroStrategy boosts its BTC holdings with a $101M purchase, signaling strong market confidence. Led by Michael Saylor, the company continues its strategic investment in Bitcoin, further solidifying its position as a major player in the crypto space.

0

Reply

Copy link

The massive purchases underscores MicroStrategy’s confidence in BTC’s future performance.

Moreover, the markets display optimism ahead of Donald Trump’s 20 January inauguration.

The president-elect promised a friendly environment for digital assets undertakings.

Furthermore, the Coinbase Premium Index (CPI) flipped positive recently, confirming the role of US investors in propelling BTC’s recovery.

Source: CryptoQuant

A positive CPI highlights increased demand for BTC on US-based trading platforms compared to their international competitors.

That signals substantial buying momentum from the United States investors.

A solid breakout past $105K could open the path towards $120K.

However, weakness at current levels could see Bitcoin retesting the vital support zone at $95K.

HBAR eyes major breakout

Hedera welcomed 2025 with a bullish leg, gaining over 20% in the first week.

The alt trades at $0.327 after gaining over 8% in the past day.

Chart by Coinmarketcap

The prevailing market sentiments support more uptrends for HBAR, with bulls target levels above $0.40.

Reclaiming this mark would open the gates toward the $0.5701 all-time high.

The digital token has traded above the Simple Moving Average on the daily timeframe since the year began, signaling robust bullishness.

Also, the Moving Average Convergence Divergence reveals fading red histograms, highlighting a bull comeback.

Also, the MACD’s positive crossover with the signal line adds credence to Hedera’s recovery trajectory.

The collaboration between Hedera Hashgraph, KIA, and Hyundai magnified HBAR’s real-world appeal.

The institutions are here for the #BitcoinETF 🏦

Meanwhile, the world’s largest organizations are already building on @Hedera.

@Hyundai and @Kia, South Korea’s largest car manufacturers, are actively using #Hedera to track the carbon emissions of their supply chains 🇰🇷

View replies

597

Reply

Copy link

The prevailing momentum could propel HBAR past crucial resistance for a smooth sail to the sought-after $1 in the coming sessions.

That would lead to a remarkable 200% surge from current prices.

Worldcoin price hits monthly highs

WLD displayed notable recoveries over the past day as magnified trading volumes propelled prices to new monthly peaks.

The AI token hit a daily peak of $2.78 before sliding to $2.61 at press time.

Chart by Coinmarketcap

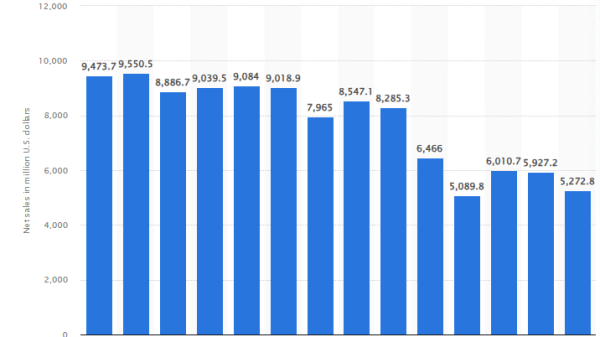

The 140% surge in 24H trading volume highlights significant trader activity behind Worldcoin’s prevailing performance.

The Smart Money Index (SMI) supports WLD’s upside stance.

The indicator has increased by 36% since 31 December to 1.91 at press time, suggesting increased buying and trust in the asset.

Meanwhile, bulls should ensure a daily candlestick closing above $2.70 to support Worldcoin’s trajectory.

That could catalyze continued gains to $3.25, opening the path toward multi-month peaks of $4.22.

However, Worldcoin enthusiasts should watch the anticipated token unlock, which might trigger volatility.

The project scheduled a massive token release between January 5 and 7.

It will flood the market with over 37 million WLD assets (worth approximately $90 million).

CryptoRank data show the initial 5.02 million unlock starts today.

Source – Cryptorank

Worldcoin will likely witness notable selling pressure during the token release events.

The post Altcoin update: HBAR and Worldcoin turn bullish as Bitcoin holds above $100K appeared first on Invezz