Bloomberg reported recently that “Kroger Co. said it plans to lower grocery prices by $1 billion” if federal regulators approve the proposed $25 billion merger with Albertsons. While antitrust litigation slows the merger’s progress, that leaves the company with plenty of time to unpack that promise.

What does it mean to lower total future prices by a set amount? Does that mean $1 billion lower than this year’s levels, or lower than projected price levels for next year? Given the complexity of the sheer number of products on offer, different locations, and constantly shifting costs, it is unclear what this announcement means. How can Kroger promise to lower prices when the future costs of inputs are unknowable? At best, the outcome of this promise would be impossible to measure. To do that, we would need to compare it to a hypothetical of what the price levels would have been without this commitment.

The facts are more complicated than what was reported. When I reached out to Kroger for comment, a spokesperson said, “We can confirm this number is correct and consistent with what we continue to share with regulators. As we’ve prepared for integration since announcing our planned merger nearly two years ago, we continued our ongoing work to confirm and increase opportunities to generate efficiencies to invest back in customer prices, associate wages and store experience. After the merger closes, Kroger will invest $1 billion to lower Albertsons’ prices, consistent with Kroger’s track record of fighting inflation and providing value to customers.” (emphasis added)

This statement reveals a different promise than simply lowering prices by $1 billion, as reported. Kroger plans to invest $1 billion dollars to lower prices. This statement makes more sense, as the company wouldn’t be able to guarantee the price levels at some future time. It could however, pledge a set amount to increasing efficiencies and improving its supply chain. The result of that investment on prices is unclear.

The original article in Bloomberg, which has been widely cited, including by Reuters, does not link to a source, so we don’t have the exact wording of the original announcement. At least one outlet has used the exact same language the Kroger spokesperson gave me, so it is possible that Kroger is giving the same statement to every journalist who inquires. The author of the original Bloomberg article did not respond to my requests for the source of the original story, so I don’t know whether the author re-worded the commitment or whether there are multiple statements circulating.

Putting the wording of the statement aside, antitrust litigation creates strange debates over prices — debates which are often disconnected from market realities. Kroger had previously committed to investing $500 million to lower prices, but has now raised the number to $1 Billion without providing an explanation of the underlying reasoning. You can picture the executives and consultants sitting in a room making up numbers, debating the $500 million or $1 billion announcements. The antitrust argument compels companies to make these types of assertions.

Kroger’s more convincing case is that the merger will lower prices based on economies of scale. In line with its statement above, it plans to “generate efficiencies” by merging the supply chains of the two grocery chains. CEO Rodney McMullen said in a statement to Supermarket News, “We believe the way to be America’s best grocer is to provide great value by consistently lowering prices and offering more choices. When we do this, more customers shop with us and buy more groceries, which allows us to reinvest in even lower prices.”

As I have written elsewhere, a key part of the debate over antitrust litigation centers around anticompetitive behavior. Pricing strategies are often used as evidence of such behavior. The problem that quickly arises is that, as it pertains to pricing, competitive behavior looks a lot like anticompetitive behavior. Lowering prices could unfairly hurt rival companies, but raising them looks like harming consumers. Given enough choices, consumers will gravitate towards the options with the best combination of price and quality to fit their needs. Were the Kroger-Albertsons merger to proceed and result in higher prices, that would give space for Aldi, Walmart, or other budget-friendly options to capture market share.

Regardless of the outcome of antitrust cases, it is nonsensical to say that Kroger will lower grocery prices by $1 billion. Prices reflect complex market realities of supply and demand over time, myriad constantly shifting factors. Only time will tell whether it follows through with the commitment to invest $1 billion to lower prices. Consumers would be better served if companies could spend more time on improving their services and less on fending off litigation.

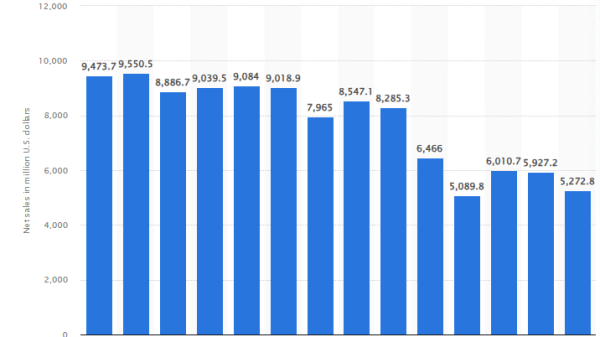

So far, Kroger and Albertson have spent more than $800 million on merger fees, as reported by Bloomberg. The high costs Kroger faces reflect the cases seeking to block the merger. Other than the many lawyers and consultants booking extra hours, the public are not served by these outlays. Gimmicks and commitments to regulators are immaterial compared to market innovation.