The Republican Party wages an internal battle while the US economy teeters on the edge of a potential recession, marked by a weakening labor market and volatile financial conditions. The debate within the party is not just over political leadership, but the very economic principles that will define the nation’s future. With inflation-adjusted wages down since January 2021 and savings rates at historic lows, a pro-growth economic agenda is urgently needed.

Yet, some within the GOP or right-leaning groups are pushing for a dramatic shift away from the free-market capitalism that has historically driven American prosperity. The deviation threatens to undermine decades of economic success.

The “New Right,” represented by groups like American Compass, advocates for a return to big-government policies. Under the guise of a new form of conservatism, this faction argues for increased government intervention in the economy, protectionist measures, and the strengthening of monopoly labor unions.

Oren Cass, who leads American Compass, pushed this interventionist approach in his article “Free Trade’s Origin Myth” at Law & Liberty:

“As the American people, and American policymakers, rediscover the importance of promoting domestic industry and protecting the domestic market, economists have a vital role to play in analyzing how best to accomplish the nation’s goals.”

Cass claims these policies will benefit workers and domestic industries, yet history and economics tell us otherwise. The New Deal, Great Society, and more recent Obama-Biden policies, all rooted in similar principles, have repeatedly demonstrated the failure of such approaches to deliver sustainable economic growth.

This misguided movement threatens the free-market policies that have been the hallmark of much of GOP economic policy. American Compass and its allies call adherents to these principles “free-market fundamentalists,” suggesting that the time has come for the GOP to abandon the policies that have lifted millions of Americans out of poverty and spurred innovation and economic growth.

Consider the economic successes of the Trump administration during its first term — a period characterized by substantial deregulation and tax cuts.

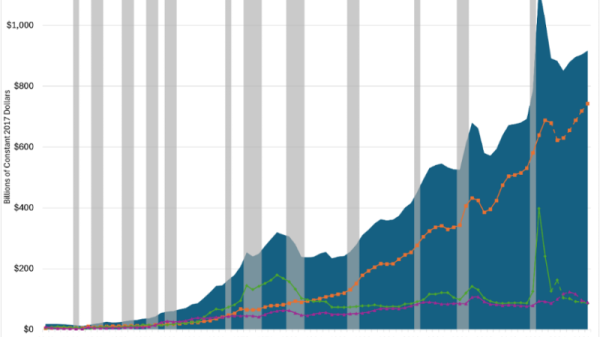

The American Action Forum calculates the final rule costs at the same point of the last three administrations. The latest through August 23 in the fourth year of each term had final rule costs of $311.7 billion for Obama and $1.67 trillion for Biden, while Trump had a decline of $100.6 billion. The cost of doing business was lower under Trump than the other two. According to the Competitive Enterprise Institute, there is always room for more cuts: the high costs of regulations currently top $2.1 trillion per year.

The Tax Cuts and Jobs Act helped boost the economy by lowering tax rates, contributing to more incentives to work and invest. The Trump tax cuts and deregulation empowered more economic growth, more job creation, and greater income distribution, by allowing the private sector to thrive. Before the destructive pandemic-related lockdowns, real median household income increased by $5,000, wages increased by nearly 5 percent, and the poverty and unemployment rates reached their lowest in 50 years.

These gains, however, are now at risk as key provisions of the tax cuts are set to expire in 2025, and the fiscal crisis driven by government overspending threatens to reverse this progress.

The GOP must resist the allure of the “New Right” and reaffirm its commitment to pro-growth policies that prioritize economic freedom and limited government. This begins with reducing government spending, which is essential to making the Trump tax cuts permanent and preventing a tax hike that would stifle economic recovery. Simplifying the tax code by eliminating special provisions that pick winners and losers would further enhance economic efficiency and equity.

In addition to tax reform, the GOP must focus on streamlining welfare programs and enforcing work requirements. These policies would reduce dependency on government assistance, encourage labor force participation, and strengthen families by promoting self-sufficiency. The economic benefits of such reforms are clear: a more robust labor market, higher productivity, and greater economic mobility.

Embracing free trade is likewise crucial for maintaining America’s competitive edge in the global economy. Protectionist measures, as advocated by the “New Right,” may offer short-term relief to specific industries but ultimately harm consumers, reduce innovation, and weaken the broader economy. On the other hand, free trade fosters competition that drives technological advancement and delivers lower prices and more consumer choices.

The GOP should also prioritize fostering innovation, particularly in the technology sector. The US can lead the next economic revolution by reducing regulatory barriers and promoting a pro-innovation environment, driving productivity and economic growth for decades.

The alternative — a retreat into the big-government policies championed by the “New Right” — would be disastrous. Higher tariffs, increased taxes, and greater government and union control over the economy would exacerbate economic stagnation, fuel inflation, and increase poverty. They echo the failed strategies of progressive leaders like Woodrow Wilson, Franklin D. Roosevelt, and Lyndon B. Johnson — policies that expanded government power at the expense of economic freedom and prosperity for ordinary Americans.

The path forward for sound policy is to embrace a pro-growth approach championed by the American Institute for Economic Research, Club for Growth’s Freedom Forward Policy Handbook, Americans for Tax Reform’s Sustainable Budgeting, among others. Reducing government spending, taxes, regulations, and the money supply will unleash abundance.

By recommitting to pro-growth principles, the GOP can present a compelling alternative to the electorate and pave the way for a more prosperous future. Or, it can follow the “New Right” down the progressive road to serfdom.