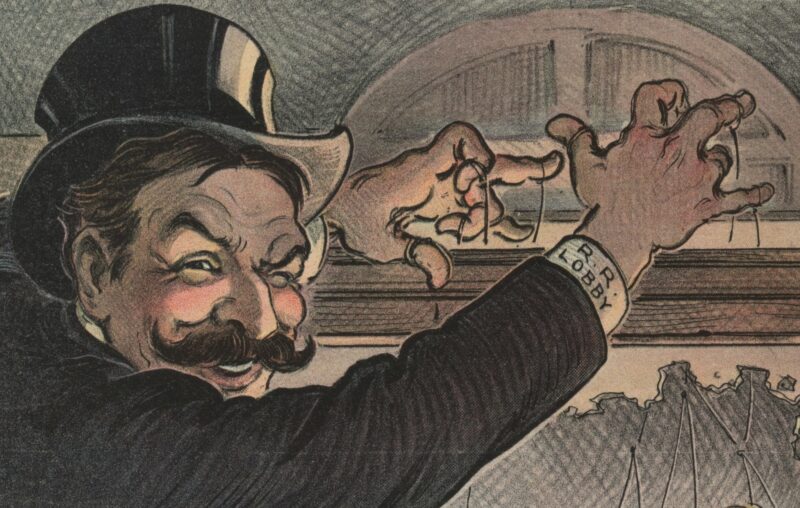

Whenever financial assistance or opportunities for achieving favorable gains are present, rent-seeking often follows. Rent-seeking, as conveyed by Robert Tollison refers to “the expenditure of scarce resources to capture an artificially created transfer.” Simply put, rent-seeking “involves seeking to increase one’s share of existing wealth without creating new wealth.” As such, who the givers and the receivers are matters a great deal, as does who determines the requisites for the gains – thereby setting the ‘rules of the game.’

Gordon Tullock featured the concept of rent-seeking in his 1967 paper, “The Welfare Costs of Tariffs, Monopolies, and Theft,” but it wasn’t until Anne Krueger’s 1974 study, “The Political Economy of the Rent-Seeking Society,” that it gained significant attention. Krueger found the requirements for import licensing generated rent-seeking behavior and she believed that the presence of rent-seeking “surely affects people’s perception of the economic system.” Krueger asserted that rent-seeking results in economic distribution being viewed as “the outcome of a lottery,” with some winners and some losers. Fifty years later, her assertions still hold true and, unfortunately, the practice of rent-seeking has persisted and proliferated.

Great examples of rent-seeking can be found in the 2024 Congressional Pig Book which cites how Senator Bernie Sanders was able to secure a $500,000 earmark for the Vergennes Opera House in Vermont. As noted in the Pig Book:

The opera house’s website contains a laundry list of needs ranging from a new heating boiler to new seating and estimates the total cost would be $178,000. Thanks to Sen. Sanders’ earmark, the Vergennes Opera House can address everything and pocket the extra $322,000.

Rent-seeking is a process of acquiring and accumulating, instead of innovating and creating. To be sure, resource development and ingenuity are not needed when existing rents can be competed for.

If one can apply for a grant, a scholarship, a subsidy, or a tax credit – it would be rational to do so. If one can (or needs to) attain a license, a permit, or favorable legislation – it would make sense to appeal for such. If one could respectfully request donations, sponsorships, and contributions to further a preferred cause – it would be reasonable to solicit funds. Most of us have engaged in these acts. I certainly have. But we must remember that assistance is never truly ‘free’ nor is it ever limitless. Fredric Bastiat, in his 1848 essay, Government, puts it perfectly:

We are all making some similar request to the Government; but Government cannot satisfy one party without adding to the labor of the others. Government is the great fiction through which everybody endeavors to live at the expense of everybody else. Every one is, more or less, for profiting by the labors of others.

Rent-seeking, however, doesn’t seem to be a concern for Senator Sanders who claims the American people want assurance of government assistance. During a recent appearance on “Face the Nation,” Senator Sanders gave America’s laundry list of needs and he has been a champion for student loan forgiveness and the Medicare for All program. Senator Sanders, however, should be made aware that rent-seeking is not an isolated activity. Resources and effort are required to compete for or maintain rents and so opportunity costs must be taken into account, especially for unsuccessful attempts at attaining rents. Even successful forms of rent-seeking though will generate adverse effects since such behavior produces net costs for society overall.

Let me explain:

Pecuniary transfers, which leave the effectiveness of a free market in question, will entice others to engage in rent-seeking behavior. More rent-seekers means more competition for rents, and more competition for rents means more is needed to vie for rent attainment. And, the more effort and resources being directed toward capturing rents, means less is being used for productive or entrepreneurial purposes.

Costs for acquiring rents will rise over time and economic productivity will decline, and it will continue in such a fashion until the cost of competition becomes too great or rents run out. And when that time comes, reviving a market-based economy will be a difficult task since the provision of existing rents diminishes incentives to seek out new or alternative forms for income generation or productive exchange. The trader principle does not apply when one must curtail a choice of action to the stipulations and expectations of those who control allotments.

Rather than the coordination of knowledge by means of price signals and purchases, or the use of competitive strategies to capitalize on market opportunities, ambitions will be redirected toward what is available. And, when the demand for rents exceeds the amount that can be distributed, the creators of wealth will be called upon to contribute to a greater degree — assuming there are still a few capitalists who can be called upon. Senator Sanders is banking on such since he has signed a letter, addressed to President Biden and Treasury Secretary Janet Yellen, urging support for a global wealth tax.

Capitalists, those who seek to profit from voluntary exchanges, are being pressured to hand over their fair share to assist with rents and, if the amount expected becomes too great (consider the Laffer Curve) or goes against one’s values (read Atlas Shrugged), then capitalists (and their capital) may be hard to come by over time.

Let me elaborate:

Capitalism in its truest form has never been fully tried given the presence of a mixed economic system, which integrates the political and economic realms. Government interests and interference in the marketplace has kept pure capitalism at bay and given us cronyism and corporatism instead.

Under a system of true capitalism, businesses would operate with success being dependent on the market process of exchange and have a government that upholds the protection of private property. What businesses have today is the right to own property with the government intervening with how that property operates and transacts. The government is directing the use of property rather than protecting it. As such, permissionless innovation seems to be a thing of the past and any business that grows too big will inevitably find itself restricted.

Under our current system, businesses operate with less certainty given the subjective nature of some standards, the retroactive application of select rules, and the murkiness of various established case laws. The growth in power of government agencies overseeing business matters comes at the cost of market power and business dynamism. And, over time, this will generate greater disparity between the haves and the have nots, since status positions will comprise of givers, receivers, and what could be categorized as non-achievers (those who have lost faith in the market and have no means for competing for rents). For non-achievers there will be a persistent race to the bottom because if assistance were to ever be granted to help those in greatest need, they would need to prove they fit the bill. And eventually, more of the ‘receivers’ will fall into the category of ‘non-achievers,’ either because competition for rents has gotten too high or because the distribution of rents has been squeezed too much.

Let me sum up:

The more the state becomes involved in everyday affairs, the more we move to a rent-seeking society, enabling a power dynamic based on what can be accessed rather than on what can be earned. When our means for advancement are dependent on rents, rather than through advantageous mutual exchange, a market economy will cease to exist. Rent-seeking normalizes individual conduct and producer practices according to the requisites for rents and when the activities for acquiring or distributing rents become greater than that which can be derived from producers, we will all be to blame for what follows.

The soul of enterprise will be replaced by relations of power and dependency. Economic concerns are therefore only one side of the equation, the other is social degradation. The ability to profit from an exchange or an activity must always be greater than that which can be granted by the government. And we must all be mindful of that.