The largest event on the American sports calendar is once again about to take place, but with an interesting twist this year. Super Bowl LX ticket prices have declined sharply as kickoff approaches, offering what appears, at first glance, to be a rare instance of consumer relief. As of February 2, secondary-market “get-in” prices had fallen into the mid-$4,000 range, with major platforms listing entry points between roughly $4,400 and $4,700. Average resale prices — still elevated by any historical standard — have eased into the vicinity of $8,000. Most notable is the pace of adjustment: minimum prices dropped by more than 25 percent in the final week alone.

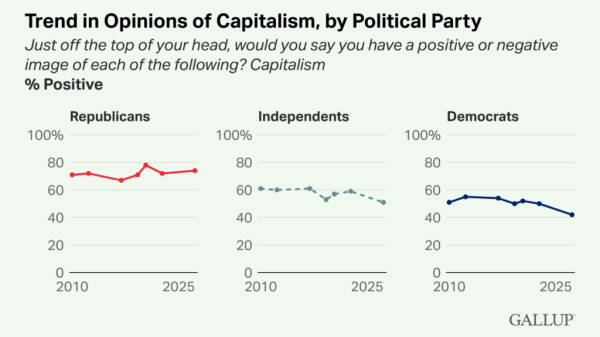

Superficially, this resembles deflation. In reality, it reflects a market-clearing process under tightening household budget constraints rather than any meaningful improvement in purchasing power.

The decline in Super Bowl ticket prices should not be interpreted as evidence that high-end entertainment has become more affordable. Instead, it illustrates how discretionary luxury markets respond when consumers encounter binding affordability limits, even as the general price level remains structurally higher. The Super Bowl is not becoming cheaper; marginal demand is simply proving more price-sensitive than sellers initially assumed.

Venue and location amplify these dynamics. Super Bowl LX is being held at Levi’s Stadium in Santa Clara, within one of the highest-cost metropolitan areas in the United States. Travel, lodging, and food prices in the Bay Area already rank near the top nationally, and Super Bowl week magnifies those pressures. Hotel rates surged early, flights filled quickly, and basic logistical costs carried substantial premiums.

Under these conditions, the ticket market becomes particularly sensitive to late-cycle demand elasticity. Price declines have been concentrated in upper-level end-zone seating — the lowest-quality inventory — while midfield and lower-bowl seats continue to command significantly higher prices. This segmentation suggests that consumers remain willing to attend, but only within a narrower willingness-to-pay band.

Demand composition further explains the volatility. Interest from Washington State and Massachusetts fans has been strong, but that enthusiasm has not translated into unlimited price tolerance. As the event approaches, sellers who priced aggressively earlier in the cycle face increasing inventory risk. Unsold tickets rapidly transition from appreciating assets to expiring liabilities, forcing repricing.

Late-stage price declines are typical in Super Bowl ticket markets, particularly within the final 72 hours. What distinguishes this year is the magnitude and speed of the adjustment. A decline exceeding 25 percent in a single week points to a binding affordability constraint rather than routine tactical discounting. Interpreting this price movement as evidence of disinflation would be a mistake. If anything, it reflects the opposite: households are making increasingly sharp consumption tradeoffs because essential costs remain elevated.

Luxury Prices are Adjusting — Because the Cost of Living Isn’t

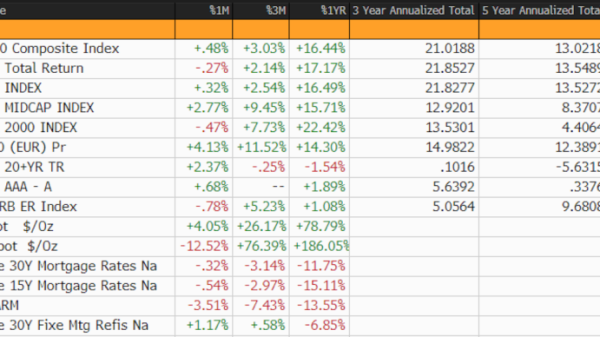

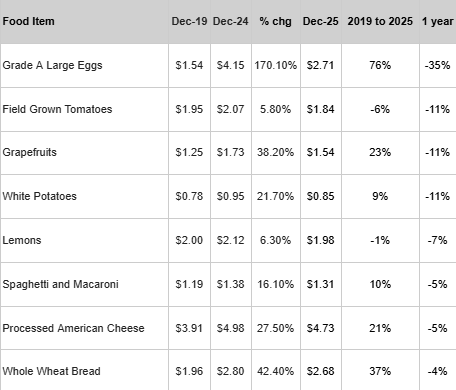

CPI “Average Prices by Product” data highlight the persistence of these pressures. Coffee prices have risen more than 120 percent since 2019 and remain over 30 percent higher than a year ago, transforming a low-salience daily purchase into a recurring budgetary strain. Egg prices, despite falling more than 30 percent over the past year, remain roughly 75 percent above their 2019 level, indicating that volatility has subsided but the price floor has shifted upward. Orange juice prices — particularly frozen concentrate — have more than doubled since 2019 and continue to edge higher year over year, underscoring ongoing supply-side constraints.

There are limited offsets. Staple carbohydrates such as pasta and potatoes are up only about 10 percent since 2019 and are cheaper than a year ago. Gasoline prices have risen less than 25 percent since 2019 and have declined modestly over the past year. But these improvements are insufficient to materially offset higher costs elsewhere in household budgets.

Lower fuel prices have not translated into broad grocery relief, and marginal savings on select staples are overwhelmed by sustained increases across other categories.

Importantly, affordability pressures operate not only through aggregate inflation measures but also through psychologically salient price thresholds. Egg prices falling below $4 per dozen and gasoline slipping under $3 per gallon provide visible, if limited, relief. At the same time, bread prices remaining above $2 per loaf and coffee prices moving decisively out of “low-cost staple” territory reinforce the perception that the overall cost structure of daily life has permanently shifted upward.

These reference points shape consumer behavior more directly than year-over-year inflation rates. They form the backdrop against which discretionary purchases — such as Super Bowl attendance – are evaluated. Super Bowl celebrations at home have also increased in price, with Wells Fargo estimating an increase of 1.6 percent to $140 (for 10 guests) this year.

PepsiCo recently announced it is cutting the suggested retail prices on several of its core snack brands — including Lay’s, Doritos, Cheetos and Tostitos — by up to 15 percent in an effort to address consumer affordability concerns amid broader economic strain. The price reductions, rolling out ahead of Super Bowl weekend, are framed by the company as a response to rising everyday costs that have made purchase decisions “harder” for many households, particularly those with tighter budgets. PepsiCo executives indicated that prior price increases had weighed on demand, and that lowering prices was intended to make its products more accessible and stimulate volume growth after consumers began trading down or curbing discretionary purchases.

Discretionary Spending is Tightening

The Super Bowl remains a luxury good. An $8,000 average resale price does not indicate broad affordability. The rapid late-stage price decline, however, offers insight into consumer behavior in the current environment. Households appear willing to allocate resources to exceptional experiences, but only after exhausting adjustment margins: delaying purchases, accepting lower quality, reducing ancillary spending, or opting out altogether. In effect, discretionary markets are absorbing the adjustment that essential-goods prices have failed to deliver.The ticket selloff is not a consumer victory so much as a pressure release that allows the market to clear. It highlights a broader economic reality heading into Super Bowl weekend: even as inflation moderates in certain categories, households continue to operate under a permanently higher price level for everyday necessities. A 25-percent drop in the cost of attending the largest sporting event of the year does not signal renewed affordability. It signals that consumers are already constrained — and that sellers are increasingly aware of where those limits lie.