Micron stock (NASDAQ: MU) surged after reporting record revenue of $13.64 billion and robust year-over-year earnings growth in its first fiscal quarter of 2026.

The analyst consensus now forecasts full-year earnings near $32.14 per share, a nearly fourfold jump from $8.29 a year earlier.

Strong data-center demand has pushed both DRAM and High-Bandwidth Memory (HBM) pricing to levels unseen in a decade.

Yet beneath the headlines lies a genuine tension: today’s supercycle may not last forever, and investors must weigh the opportunity against the company’s historical cyclicality.

Micron stock: DRAM and HBM lift margins

The core of the bull case is deceptively simple: memory demand overwhelmingly exceeds supply.

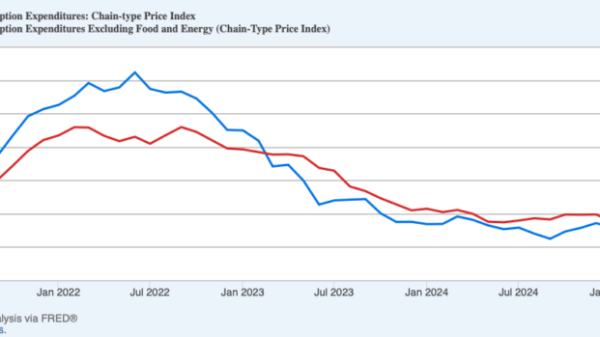

Micron reported that DRAM (Dynamic Random Access Memory) prices surged approximately 20% sequentially in fiscal Q1 2026, driven by acute industry shortages.

That price increase translates directly to margin expansion.

In Q1, gross margin hit 56%, a record. For Q2, the company is guiding to 68% gross margin, a level that signals pricing power has reached nearly monopolistic proportions.

The real story, however, centers on HBM (High Bandwidth Memory).

Micron’s entire 2026 HBM capacity is already sold out, but it is fully committed to customers through long-term supply agreements.

CEO Sanjay Mehrotra stated on the earnings call that the company can currently meet only 50–67% of customer demand because HBM production is physically constrained by cleanroom and equipment capacity.

This scarcity translates into margin leverage that ordinary memory suppliers never enjoy.

Bernstein analysts project DRAM prices will sustain 20–25% quarterly increases through the first half of 2026, implying $32–$40 in fiscal 2026 EPS across a range of analyst models.

The addressable market for HBM itself is expanding faster than anyone anticipated.

Micron now expects the HBM market to reach $100 billion by 2028, a 40% compound annual growth rate through 2026–27.

That acceleration is driven by hyperscalers’ insatiable appetite for GPU memory.

Each AI data-center rack now demands six to eight times more DRAM than conventional enterprise servers.

For investors, this means the profit lift isn’t just a cyclical bounce-back; it reflects structural, multi-year tailwinds in AI infrastructure spending.

Cyclical risk remains the chief caveat for investors

The counterargument is equally straightforward: memory is the semiconductor industry’s most cyclical segment.

History warns that today’s tight supply creates tomorrow’s capital expenditure binges.

Micron itself is raising capital expenditures (capex) to $20 billion in fiscal 2026, and competitors Samsung and SK Hynix will likely follow suit.

If all these new fabs come online simultaneously in 2027–28, precisely as AI hardware growth moderates, the industry could swing into oversupply.

Additionally, valuation concerns loom. At current prices near $315 per share, Micron trades at elevated multiples to 2026 earnings, pricing in perpetually tight conditions.

The near-term catalysts matter immensely.

The traders will likely keep a close eye on cloud capex guidance in Nvidia and Microsoft earnings, and watch weekly DRAM price indices from brokers.

If pricing flattens or inventory begins to rebuild, expect volatility.

The post Micron stock: here’s why it is still a buy despite mixed guidance appeared first on Invezz