In its manifesto for the 2024 general election, Britain’s Labour party listed “Five Missions to Rebuild Britain,” the first being: “Kickstart economic growth.”

The party’s second budget since winning that election, delivered on November 26 by Chancellor of the Exchequer Rachel Reeves, suggests it has already abandoned that mission—and offers a cautionary tale to other governments on what not to do.

Tax, Borrowing, and Spending Hikes

Before the election, the Financial Times quoted Reeves admitting that, unlike previous incoming chancellors, she would not be able to claim she had “looked inside the books and realized things were even worse than they looked from the outside, giving a flimsy excuse for immediate tax rises or spending cuts.” She promised no increase in national insurance (NI, a payroll tax like Social Security), income tax, or Value Added Tax (VAT, a national sales tax).

Once elected, Reeves claimed she had, after all, looked inside the books—and discovered a £21.9 billion “black hole” in government finances. This supposedly arose from the previous Conservative government’s failure to spend enough, curious given that in 2023–2024, government spending as a share of GDP was higher than in all but seven of the previous 75 years.

Reeves now had her “excuse for immediate tax rises” in the October 2024 budget. Public sector workers were rewarded for supporting Labour with a £9.4 billion pay hike—42.9 percent of the alleged “black hole”—while the perpetually cash-hungry National Health Service received £1.5 billion. To fund this, Reeves raised taxes by £40 billion—the largest increase since 1993—including a two-percentage-point hike in employer NI contributions. She denied breaking her pre-election promise, noting that the employee share was unchanged, but this convinced no one. Overall, taxes were forecast to reach “a historic high” as a share of GDP.

Incredibly, the Office for Budget Responsibility (OBR, Britain’s version of the Congressional Budget Office) projected that Reeves’ budget would push government spending, taxes, borrowing, inflation, and interest rates up, while driving employment, disposable income, and GDP growth down.

The Economy Crashes

This is exactly what happened.

The unemployment rate is up from 4.3 percent in the three months to October 2024 to 5.0 percent in the three months to September 2025 and the number of “payrolled employees…fell by 117,000 (0.4%) between September 2024 and September 2025,” according to the Office for National Statistics. Over 40 percent of organizations reported reducing employee numbers in response to the payroll tax rise, according to last month’s Bank of England Decision Maker Panel survey, and one-third said likewise for a hike in the minimum wage.

Growth of Total real pay, 2.4 percent in the three months to October 2024, is down to 0.7 percent in the three months to September 2025. Much of this is due to resurgent inflation. Annual growth in the Consumer Price Index is up from 2.3 percent in October 2024 to 3.6 percent in October 2025. “The government has undoubtedly added to, and extended, the inflation problem with its generous public pay settlements and minimum wage increases,” says Paul Dales, chief UK economist at Capital Economics.

“The underlying fiscal outlook has also deteriorated since October,” the OBR noted in March, but it has continued deteriorating and, in November, it reported that “Borrowing in 2024-25 is £12 billion higher than estimated at the time of the March forecast.” Meanwhile, Martin Wolf notes for the Financial Times, “the yield on UK government bonds is one of the highest among all advanced economies.” Indeed, British government bond yields are now higher than those which brought Liz Truss down when she was said, by Reeves, to have “crashed our economy” in 2022. Kier Starmer’s government finds itself in the difficult position of having levels of borrowing and the cost of that borrowing increasing at the same time. Of course, it is a situation they chose to put the country in.

More Taxes, Borrowing, and Spending Hikes

Before the November 26 budget, Reeves—like some fiscal Hubble telescope—had discovered yet another “black hole.”

Closing it required raising “taxes by amounts rising to £26 billion in 2029–30, through freezing personal tax thresholds and a host of smaller measures,” the OBR noted. Freezing the thresholds will push 5.4 million additional people into the higher- and additional-rate tax bands by 2030, in what the Centre for Policy Studies calls the largest tax rise in at least the last 60 years. It breaks another of Reeves’ pre-election pledges—not to raise income taxes—and “brings the tax take to an all-time high of 38 percent of GDP in 2030–31,” the OBR reports.

But again, this wasn’t really about plugging some “black hole”—which Reeves may have lied about anyway—but about financing yet another expansion of government spending, mostly on welfare. “Budget policies increase spending in every year and by £11 billion in 2029–30,” the OBR reports, “primarily to pay for the summer reversals to welfare cuts and lift the two-child limit in universal credit.” Government spending will be higher as a share of GDP in 2030–31 than in 70 of the last 78 years.

Perhaps this could be justified if it were likely to “kickstart economic growth,” as Labour promised—but it won’t. The OBR revised real GDP growth for 2025 up from 1.0 percent to 1.5 percent but revised it downward for every year afterward owing to Reeves’ fiscal measures. Growth now averages 1.5 percent over the forecast, 0.3 percentage points slower than in March. The National Institute of Economic and Social Research estimates that fiscal policy will shave 0.4 percentage points off growth over the next five years. In October, real GDP shrank for the fourth month in a row.

Lessons for the United States

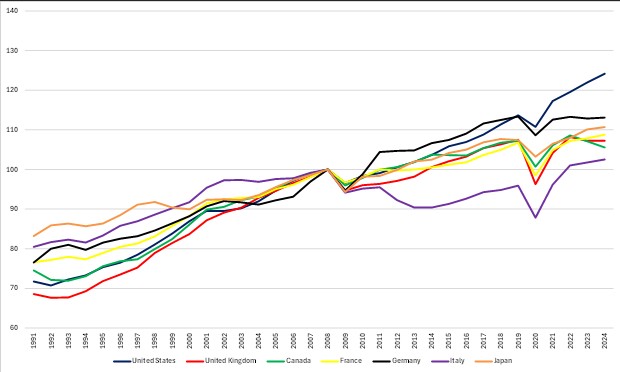

The United States shares Britain’s problems of yawning deficits and spiraling debts but, relatively speaking, it does not share its chronic inability to generate economic growth. Since 2008, GDP per capita has increased by 7.3 percent in real terms in Britain compared to 24.2 percent in the US, as Figure 1 shows.

Figure 1: Real per capita GDP growth, 2008 = 100 (PPP, constant 2021 international $)

Source: World Bank World Development Indicators

This Labour government’s economic record illustrates the folly of trying to close budget gaps—driven in part by a vastly expanding welfare state—through payroll tax hikes and minimum wage increases, soon to be joined by higher income taxes. These measures are strangling economic growth in Britain and would do the same in the United States if attempted here. You cannot expand your welfare state by shrinking your economy.

To the extent Labour is still thinking about growth, it diagnoses the problem as one of insufficient demand—much like the Biden administration did with its misnamed Inflation Reduction Act. It isn’t. Britain’s growth problems are supply-side, and so are the remedies. The issue is not a lack of money to spend but a lack of things to spend it on. Perhaps the most important lesson for the United States and any other country facing this familiar cocktail of problems is simple: it’s the supply side, stupid.

In opposition, Labour and affiliated think tanks made noises suggesting they understood this. In office, Kier Starmer and Rachel Reeves have delivered Labour at its most neanderthal, providing policymakers elsewhere with a cautionary example of what not to do.