SoftBank Group shares fell sharply on Thursday after Oracle’s weaker-than-expected quarterly results renewed worries about how long it will take for massive investments in artificial intelligence infrastructure to translate into profits.

The stock closed down nearly 7.7% in Tokyo, having dropped as much as 8.4% intraday, dragging the broader market lower.

Oracle said its revenue and operating income for the latest quarter came in slightly below analysts’ expectations, while also raising its spending forecast.

The cloud-computing company’s updated outlook added to concerns that the industry’s aggressive data-center buildout may take longer than anticipated to generate returns, particularly as power-hungry AI models require significant upfront investment.

Oracle’s miss sends ripples through SoftBank’s AI plans

SoftBank has deep exposure to Oracle through its ambitious AI partnerships.

In January, SoftBank Group and OpenAI announced plans to invest up to half a trillion dollars in US AI infrastructure, alongside Oracle and other partners.

SoftBank is expected to lead the financing for the initiative, while OpenAI will oversee operations.

The trio, along with Oracle, also announced in September five new US AI data-center sites under the project known as Stargate.

Oracle’s underwhelming earnings and escalating capital expenditures have therefore raised questions about whether these large-scale infrastructure plans will progress on schedule.

“The Nikkei opened higher to track overnight Wall Street gains, but the advance was erased by declines in SoftBank Group,” said Tokai Tokyo Intelligence Laboratory market analyst Shuutarou Yasuda.

“Oracle’s earnings raised concerns about whether the data-center project involving SoftBank would proceed as expected.”

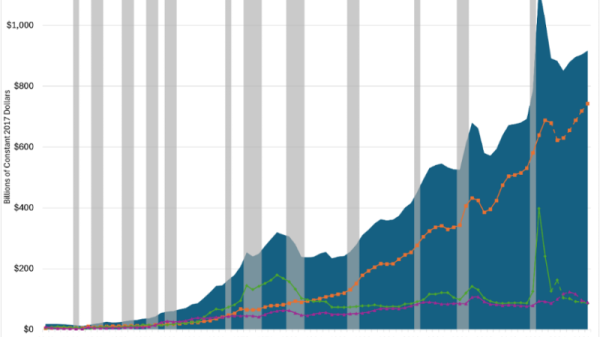

AI spending grows faster than returns

Oracle’s updated financial projections deepened investor unease.

The company forecast adjusted profit of $1.64 to $1.68 per share for the current quarter—below analyst expectations—and projected revenue growth of 16% to 18%, also missing estimates.

More significantly, Oracle said capital expenditures for fiscal 2026 would be $15 billion higher than previously expected, bringing total planned spending far above the September estimate of $35 billion.

Analysts said the rapid increase in investment requirements has unsettled markets.

“The ramp in capex and unclear debt needs are causing uncertainty among investors,” said Melissa Otto, head of research at S&P Global’s Visible Alpha.

SoftBank volatility persists amid broader AI race

SoftBank shares have swung sharply in recent weeks amid growing caution over the surge in AI-related stocks and speculation that Google may be pulling ahead in the AI race, a potential challenge for OpenAI—one of SoftBank’s most important investees.

SoftBank’s mobile-carrier unit, SoftBank Corp., announced last month it would partner with Oracle to provide sovereign cloud and AI services in Japan, further deepening ties between the two companies.

But with Oracle’s results seen as a bellwether for the capital-intensive AI infrastructure sector, the latest earnings have heightened investor scrutiny of how soon major tech and telecom groups will see returns on their multibillion-dollar AI bets.

The post SoftBank shares slide as Oracle’s earnings revive concerns over AI investment payoffs appeared first on Invezz