Micron Technology announced on Wednesday that it will wind down its Crucial consumer memory business by February 2026.

The company says that it is planning to prioritize high-bandwidth memory (HBM) for AI data centers, a strategic pivot that could squeeze retail RAM and SSD supplies just as global demand explodes.

This move marks the end of a 29-year era for PC builders who have long relied on Crucial for affordable, reliable components, signaling a new reality where enterprise AI needs trump consumer upgrades.

Why Micron pivoted: AI, HBM and the bottom line

Micron’s exit isn’t about failure; it’s about opportunity cost.

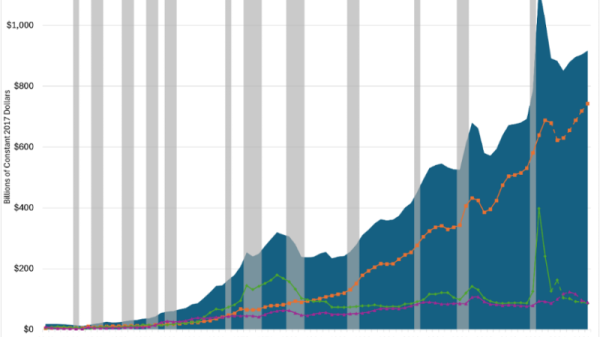

The explosion of generative AI has created an insatiable appetite for High-Bandwidth Memory (HBM), the specialized chips that power Nvidia’s GPUs and other AI accelerators.

Producing HBM is incredibly resource-intensive, requiring complex vertical stacking that consumes significantly more silicon wafer capacity than standard consumer RAM.

As Sumit Sadana, Micron’s Chief Business Officer, bluntly put it, the company made the “difficult decision” to exit the consumer business to “improve supply and support for our larger, strategic customers in faster-growing segments”.

The numbers back him up. Micron’s HBM revenue recently hit an annualized run rate of nearly $8 billion, with margins far superior to the cutthroat retail sector.

With HBM capacity already sold out through 2025, the company essentially had to choose between keeping gamers happy or fueling the AI revolution. They chose the latter.

What gamers and PC builders should expect next

For the average PC enthusiast, this is bad news.

Crucial has been a massive volume player, often acting as a price anchor that kept competitors honest. Its departure removes a huge chunk of supply from the retail channel.

Price Pressure: Expect prices for DDR5 RAM and NVMe SSDs to creep up over the next 6–12 months. When a major supplier leaves, remaining players like Samsung, SK Hynix, and Kingston gain pricing power.

Supply Gaps: While Crucial products will be shipped until February 2026, savvy builders might see stock-outs sooner as distributors pivot to other brands.

Support: Micron has promised to honor all existing warranties, so there is no need to panic-sell your current gear.

Action Plan: If you were planning a build or an upgrade, buy sooner rather than later. The “AI tax” is real, and as more fab capacity globally shifts toward server-grade chips, consumer parts will become the lower-priority, higher-cost byproduct.

Micron’s exit is a canary in the coal mine: the AI infrastructure build-out is so massive that it is beginning to cannibalize other tech sectors.

Supply chains will eventually adjust, but for the next year, everyday consumers will be competing for silicon against trillion-dollar data centers.

The post Is Micron really abandoning gamers for AI, and what happens now? appeared first on Invezz