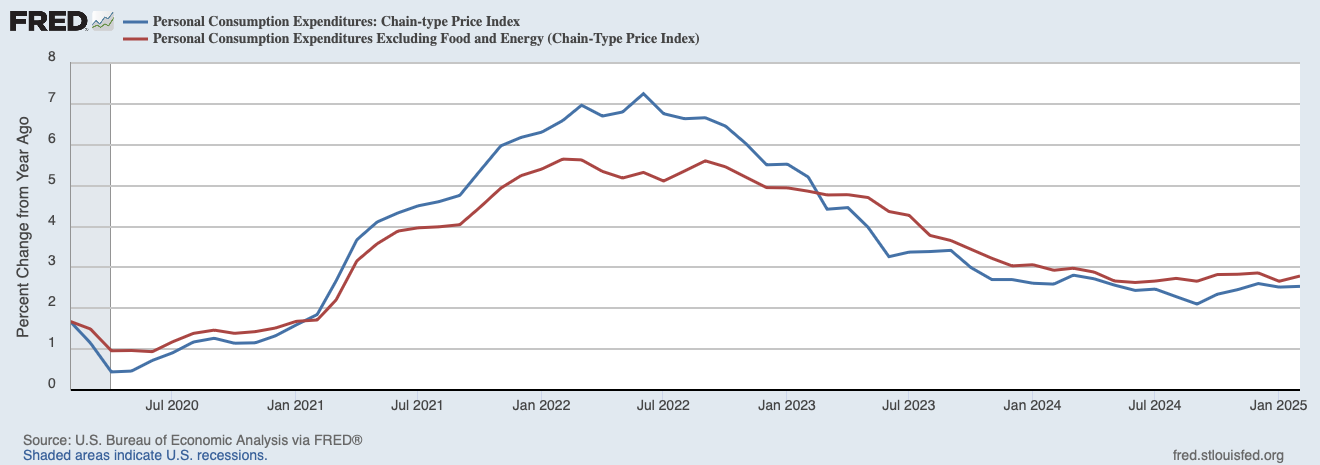

The professional forecasters were right: inflation remained elevated in February. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at an annualized rate of 4.0 percent in February 2025, down from 4.1 percent in the prior month. PCEPI inflation has averaged 3.1 percent over the last six months and 2.5 percent over the last twelve months.

Core inflation, which excludes volatile food and energy prices, grew faster still. Core PCEPI grew at an annualized rate of 4.5 percent in January 2025, up from 3.6 percent in the prior month. Core PCEPI inflation has averaged 3.1 percent over the last six months and 2.8 percent over the past 12 months.

The question facing Fed officials is whether this is a temporary blip on the path back to 2.0 percent; or, whether inflation has settled in half a percent above target. The answer depends in large part on the stance of monetary policy.

The Federal Open Market Committee voted to hold its federal funds rate target at 4.25 to 4.5 percent. Recall that the nominal federal funds rate target is equal to the real federal funds rate target plus expected inflation. Markets are currently pricing in around 2.4 percent PCEPI inflation per year over the next five years. Hence, the real federal funds rate target range is around 1.85 to 2.1 percent.

To gauge the stance of monetary policy, we must compare the real federal funds rate with estimates of the natural rate of interest. The New York Fed offers two estimates of the natural rate: the Holston-Laubach-Williams estimate was 0.80 percent in 2024:Q4; the Laubach-Williams estimate was 1.31 percent. Both are well below the federal funds rate target range, suggesting monetary policy is tight.

The Richmond Fed offers an alternative estimate of the natural rate. Its Lubik-Matthes estimate puts the natural rate at 1.89 percent in 2024:Q4. That’s close to the lower limit of the federal funds rate target range, implying that monetary policy is neutral to tight.

Together, the estimates suggest that monetary policy remains tight, though the extent to which it is tight depends crucially on the estimate used. From each, we can expect inflation will continue to decline.

There is another reason to think inflation will fall in the months ahead. Problems with seasonal adjustments have meant that inflation readings have been higher over the first four months of the year than in the final eight months of the year. In the first four months of 2023, inflation averaged 4.0 percent. Over the final eight months of 2023, it averaged just 2.0 percent. Similarly, in 2024, inflation averaged 4.1 percent over the first four months and 1.9 percent over the final eight months.

Inflation has averaged 4.1 percent over the first two months of 2025. Based on recent trends, inflation will be lower, on average, over the remainder of the year.

At the March FOMC meeting, the median member penciled in just two 25-basis-points worth of rate cuts this year. Of course, actual monetary policy will depend on how inflation and employment data evolve over the year. Futures markets are currently pricing in three cuts this year. Since FOMC members will only deliver more cuts than they have projected if inflation is lower, or real economic activity is weaker, than they currently expect it to be, the third rate cut implied by the futures market suggests those in the market believe monetary policy is tighter at present than FOMC members think. If market participants are correct, inflation will fall faster than FOMC members have projected.