The Federal Reserve’s monetary policy committee left the target range of its policy rate unchanged at its March meeting on Wednesday. It has remained at 4.25 percent to 4.50 percent since December. This decision was widely expected by market participants, given that inflation remains stubbornly above the Fed’s two-percent target.

At the post-meeting press conference, Chair Powell stated that the committee believes the US economy is strong and the labor market is balanced. He noted that wages are rising faster than inflation but are on a more sustainable growth path than earlier in the pandemic recovery.

Nonetheless, Powell acknowledged the committee’s concerns about economic uncertainty and its potential effects on spending and investment. These concerns are reflected in the summary of economic projections, also released on Wednesday. The median committee member now projects real GDP growth of 1.7 percent in 2025, down from 2.1 percent in December.

Powell noted that inflation has fallen significantly since the Fed began tightening in 2022 but conceded that it remains above the central bank’s target — and is likely to stay there for the rest of the year. The committee now projects 2.7 percent inflation for 2025, up from 2.5 percent in December.

Even more troubling, in September of last year, the median inflation projection for 2025 stood at just 2.1 percent. While inflation projections have risen sharply over the past six months, the median federal funds rate projection for 2025 has fallen: from 4.4 percent in September 2024 to 3.9 percent in the latest projections. In other words, the committee expects inflation to remain above target yet still anticipates cutting its policy rate by the end of the year.

To be sure, there is a great deal of uncertainty surrounding the new administration’s economic policies, especially when it comes to trade, immigration, fiscal policy, and regulation. Powell acknowledged as much in his remarks on Wednesday, noting that ultimately, “the net effect of these policy changes” will shape monetary policy going forward.

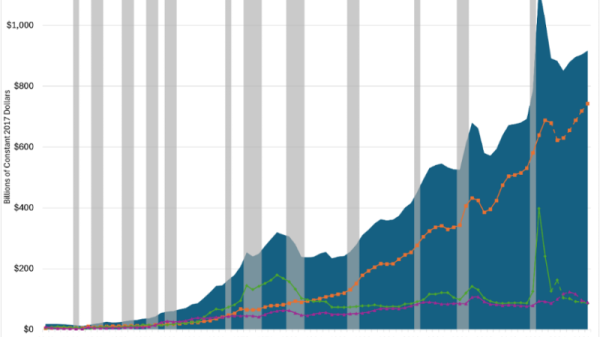

Powell also indicated that the Fed would reduce the speed with which the central bank has been shrinking its balance sheet. He noted that although market indicators point to an abundant quantity of reserves, there are early signs of tightness in the money market, which the Fed hopes to address by slowing the pace of its recent efforts at quantitative tightening. The decision to slow its balance sheet runoff was not unanimous however: Governor Waller dissented.

Finally, Powell reiterated the Fed’s commitment to incorporating the lessons of the past five years into its ongoing framework review, which he noted should be completed by the end of the summer. The Fed introduced its current framework, known as flexible average inflation targeting, in 2020. Given the shortcomings of its framework, one can only hope Powell is serious about applying those lessons.