In December 2024, the AIER Business Conditions Monthly indicators continued to show strength in leading and current economic activity, though the lagging components pointed to signs of underlying weakness. The Leading Indicator remained elevated at 71, holding steady near its November level of 79 and reflecting sustained economic momentum heading into the new year. Similarly, the Roughly Coincident Indicator climbed to 92 from 75, marking its highest reading in the past 18 months and signaling broad-based expansion in real-time economic conditions. However, the Lagging Indicator fell sharply to 17 from 50 in November, suggesting deterioration in slower-moving areas of the economy, such as credit conditions and long-term employment trends. While forward-looking and present conditions remain firmly expansionary, the divergence with lagging indicators warrants continued attention.

Leading Indicator (71)

Of the twelve components of the Leading Indicator, five increased, six declined, and one remained unchanged in January.

The most significant gain came from US New Privately Owned Housing Units Started by Structure Total SAAR, which rose 15.8 percent, indicating a strong rebound in housing activity. Other notable increases included FINRA Customer Debit Balances in Margin Accounts (0.9 percent), Adjusted Retail and Food Services Sales Total SA (0.5 percent), Conference Board US Leading Index of Stock Prices 500 Common Stocks (1.4 percent), and Conference Board US Leading Index of Manufacturing New Orders Consumer Goods and Materials (0.2 percent), all of which suggest improved liquidity and positive market sentiment.

On the downside, the 1-to-10 year US Treasury spread plunged by 408.5 percent, reflecting a dramatic yield curve shift. United States Heavy Trucks Sales SAAR (-7.5 percent), US Initial Jobless Claims SA (-6.2 percent), and University of Michigan Consumer Expectations Index (-4.7 percent) also saw declines, pointing to labor market weakness and declining consumer sentiment. Additionally, the Inventory/Sales Ratio: Total Business (-1.5 percent) and Conference Board US Manufacturers New Orders Nondefense Capital Goods Ex Aircraft (-0.1 percent) showed slight declines, indicating modest headwinds for capital investment.

Coincident Indicator (92)

The Coincident Indicator saw gains in five components, while one remained unchanged.

The strongest increase came from the Conference Board Consumer Confidence Present Situation Index (1.8 percent), suggesting improved sentiment regarding current economic conditions. Modest gains were also recorded in US Industrial Production SA (0.9 percent), Conference Board Coincident Manufacturing and Trade Sales (0.2 percent), and Conference Board Coincident Personal Income Less Transfer Payments (0.2 percent), indicating continued stability in core economic activity. Meanwhile, US Employees on Nonfarm Payrolls Total SA (0.2 percent) showed slight job market growth, reflecting ongoing labor market resilience. The US Labor Force Participation Rate SA remained unchanged, signaling that broader workforce engagement held steady.

Lagging Indicator (17)

The Lagging Indicator declined steeply, with five components falling and one rising. The only increase came from the Census Bureau US Private Construction Spending Nonresidential NSA (0.1 percent) which recorded a marginal gain indicating modest stability in business-related construction investment.

On the downside, the US Commercial Paper Placed Top 30 Day Yield (-5.5 percent) and US CPI Urban Consumers Less Food and Energy Year-over-Year NSA (-3.0 percent) both declined, reflecting lower long-term yield expectations and easing inflationary pressures. Additionally, Conference Board US Lagging Commercial and Industrial Loans (-1.6 percent) and US Manufacturing and Trade Inventories Total SA (-0.1 percent) posted slight declines, pointing to a pullback in credit expansion and inventory accumulation. Conference Board US Lagging Average Duration of Unemployment rose 0.4 percent, indicating that unemployed individuals are taking longer to find work.

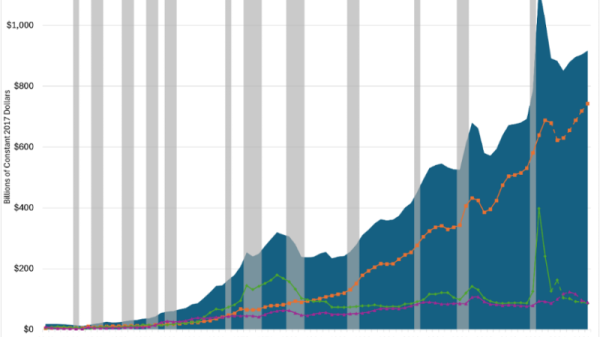

Throughout the period from January 2021 to December 2024, the Leading Indicator exhibited considerable volatility, starting at 75 in early 2021, peaking at 92 in March 2021, and then entering a prolonged decline through 2022, bottoming out at 21 in December 2022. The measure rebounded in 2023, fluctuating through the year before rising sharply to 79 in November 2024 and remaining elevated in December 2024, indicating ongoing economic momentum. The Roughly Coincident Indicator demonstrated stronger consistency in the meantime, maintaining levels at or above 75 for much of the period, including a peak of 100 in early 2021, before holding steady in the 75 to 92 range throughout 2024, suggesting continued strength in real-time economic activity. In contrast, the Lagging Indicator struggled throughout much of the timeframe, spending extended periods below 40, briefly reaching 75 in early 2022, but declining again, hitting zero in December 2023 before remaining subdued at 17 in December 2024.

The divergence between leading and lagging indicators underscores the lasting economic disruptions caused by the heavy-handed nonpharmaceutical interventions during the COVID-19 response, compounded by the inflationary effects of the Federal Reserve’s massive monetary expansion in 2020 and 2021, record levels of government debt and deficit spending, and the rapid expansion of the regulatory state under the previous administration. Despite these structural challenges, the past two months have seen a sharp improvement in forward-looking and present indicators, with the Leading and Roughly Coincident measures surging in November and December 2024, suggesting that business conditions and economic activity have gained momentum. However, the persistent weakness in the Lagging Indicator reflects ongoing fragility in slower-moving sectors, particularly those tied to credit conditions, debt burdens, and long-term employment trends, which remain weighed down by years of policy-driven distortions.

DISCUSSION

The January 2025 inflation report sent mixed signals, with a stronger-than-expected headline and core Consumer Price Index (CPI) print but downward revisions to prior data suggesting faster disinflation in 2024. The month’s inflationary pressures were largely driven by services, particularly shelter costs, transportation services, and recreation, alongside a continued rise in food and energy prices. Residual seasonality appears to have amplified the January reading, as the non-seasonally adjusted core CPI change closely mirrored last year’s level, while adjustments to seasonal factors led to a more pronounced month-over-month increase. While core goods prices edged higher, mainly due to used-car price increases, this was partly offset by declines in household furnishings and apparel. The breadth of inflation also widened, with 42 percent of core spending categories now seeing price gains above 4 percent annualized, up from 32 percent in December. Despite concerns over sticky service-sector inflation, the report offers little new information to alter the Federal Reserve’s stance, and a March rate cut remains unlikely. However, with inflation becoming more diffuse, policymakers may take a cautious approach before committing to any policy shifts later in the year.

Indeed, a broad range of economic indicators support the case for persistent price pressures. The ISM Manufacturing Prices Index rose to 54.9, its highest level since May, while ISM Services Prices remained elevated at 60.4, signaling ongoing expansion. Similarly, S&P Global U.S. Manufacturing and Services reports indicated rising output and selling prices, with firms continuing to pass cost increases onto consumers. Regional Fed surveys reinforce this trend, with the Kansas City, New York, Philadelphia, and Dallas Fed manufacturing and services reports all showing significant increases in prices received. Notably, the Philadelphia Fed Manufacturing Index surged to 29.7, while the Dallas Fed Services Index climbed to 13.7, nearly doubling from December. In contrast, only a handful of indicators suggest downward price movement. The Philadelphia Fed Non-Manufacturing Index saw a dramatic decline in prices received, dropping from 23.3 to -0.3, while Richmond Fed Manufacturing and Services reports showed only marginal decreases in prices received. These isolated declines, however, appear insufficient to counteract the broader inflationary pressures reflected across multiple data points.

On the wholesale side, US producer prices rose 0.4 percent in January, driven largely by higher food and energy costs, marking a third consecutive month of strong gains and signaling only limited progress on inflation ahead of new tariffs imposed by the Trump administration. The producer price index (PPI) increased 3.5 percent year-over-year, exceeding expectations, though key components feeding into the Federal Reserve’s preferred personal consumption expenditures (PCE) price index were more subdued, with declines in health care costs and airfares. However, food prices surged 1.1 percent, including a 44 percent jump in egg prices, while energy prices rose 1.7 percent, reinforcing concerns about supply-driven inflation pressures. Meanwhile, service prices climbed 0.3 percent, with traveler accommodation costs accounting for much of the increase. Given the persistent inflationary pressures reflected in both wholesale and consumer price data, market expectations for multiple Fed rate cuts in 2025 have diminished, with some economists now forecasting no cuts at all due to the inflationary impact of higher import duties.

Taken together, the consumer and producer price trends send a cautionary signal for already-extended US equity valuations, as rising input costs threaten corporate profit margins outside the tech sector. With producer prices outpacing consumer prices for a fourth consecutive month, historical patterns suggest a heightened risk of margin deterioration, similar to what occurred in 2018 and 2022. Fourth-quarter data already show a decline in S&P 500 operating margins to 15.1 percent from 15.4 percent, and while forecasts anticipate a rebound in the first quarter, sustained increases in input costs could challenge those expectations. Sectors most vulnerable to this squeeze include consumer-facing industries reliant on goods sales, as firms may struggle to pass cost pressures onto consumers. While margins in tech, consumer discretionary, and consumer staples stocks have remained resilient, that stability could weaken if inflationary trends persist, further complicating the outlook for corporate earnings growth.

In labor markets, January’s employment report signaled growing disinflationary pressures, as payroll growth came in weaker than expected and prior estimates were revised downward. Nonfarm payrolls increased by 143,000, well below the 175,000 consensus forecast, while downward revisions to 2024 data suggest job growth was overstated in real-time reports. Meanwhile, the household survey reflected a much larger labor supply due to population control adjustments, raising both the unemployment and labor-force participation rates by 0.1 percentage point. Wage growth remained firm at 4.1 percent year-over-year, but a decline in the average workweek to 34.1 hours limited overall income gains. Despite this, service industries—including health care, retail trade, and social assistance—led job creation, while goods-producing industries saw no net employment growth – an interesting finding given other data sources (described below). The decline in the unemployment rate to 4.0 percent resulted from employment gains outpacing labor force growth, but the population adjustments complicate any attempted comparisons to prior months’ data. On top of that, weather-related job absences surged in January, potentially distorting payroll data, though the Bureau of Labor Statistics noted no measurable impact from California wildfires. Government hiring added 32,000 jobs, though this trend is unlikely to continue given President Donald Trump’s stated goal of reducing the federal workforce.

Despite the January 2025 BLS report finding, other key measures point to job growth in manufacturing as well as service sectors. The Institute for Supply Management (ISM) Services Employment Index rose to its highest level since September 2023, while ISM Manufacturing signaled a return to expansion after a prolonged period of contraction. Similarly, S&P Global Services employment reached a 31-month high, and S&P Global Manufacturing reported the strongest job creation since June. The ADP report exceeded expectations with a 183,000 increase in private payrolls, and regional Fed surveys reflected broad-based improvements in hiring. Notably, the New York Empire Manufacturing employment gauge flipped into expansion, while the Philadelphia and Richmond Fed employment indicators pointed to stronger hiring momentum.

But the labor market picture was not uniformly strong, as some indicators suggested pockets of weakness. New York Fed Services employment slipped further into contraction, and Dallas Fed Services full-time employment declined after expanding in December. Initial jobless claims edged up to 223,000, while Challenger job cuts surged 28 percent month-over-month to nearly 50,000, signaling that some firms are trimming payrolls in response to shifting economic conditions. Meanwhile, the Kansas City Fed employment indicators were unchanged, suggesting stable but tepid hiring in that region. Taken together, the data indicates a labor market still exhibiting strength, particularly in services and to a growing extent manufacturing, but with emerging signs of caution as businesses navigate uncertainty surrounding inflation, policy shifts, and economic momentum.

From January into February, US consumer sentiment weakened significantly, with the University of Michigan’s preliminary February index falling to 67.8, its lowest reading in seven months. The decline was broad-based across political affiliations and driven in part by a sharp increase in short-term inflation expectations, which rose to 4.3 percent from 3.3 percent as concerns about tariffs mounted. Consumers also saw long-term inflation rising modestly, fueling worries about the future cost of living and personal finances. Buying conditions for big-ticket items (automobiles, furniture, major appliances) fell a whopping 12 percentage points, signaling heightened caution around major purchases. Confidence also dipped as consumers’ expectations for their financial situation reached their lowest level since October 2023, while views on the broader economic outlook declined along with them. Additionally, labor market softness added to concerns, with unemployed Americans taking longer to find jobs and January payroll revisions revealing weaker employment growth than initially reported. With inflation uncertainty lingering, the risk of tariffs driving up prices for households already stretched thin weighs heavily on consumer confidence and spending decisions.

Perhaps more surprisingly, US small-business optimism also declined in January, falling 2.3 points to 102.8 after reaching a six-year high in the aftermath of Trump’s election victory. Seven of the ten index components dropped, with the steepest decline in capital spending plans since 1995, reflecting a swift pullback in confidence where sizable investment decisions are concerned. Fittingly, the uncertainty index surged by 14 points, its largest monthly jump in data going back to 1986, as businesses grappled with the Federal Reserve’s rate pause and looming trade policies. While nearly half of small-business owners still expect economic conditions to improve, optimism is cooling rapidly as fewer see it as a good time to expand and expectations for easier credit conditions declining for the first time since August. At the same time, sales expectations remained near a four-year high, suggesting continued business resilience. Both consumers and small-business owners are weighing the impact of tariffs and inflation pressures, with households growing more cautious while businesses remain moderately optimistic about the broader economic outlook despite mounting uncertainties.

Retail sales declined in January following a strong holiday season, as colder-than-usual weather and post-holiday spending fatigue weighed on consumer activity. Headline retail sales fell 0.9 percent, well below expectations, with vehicle sales accounting for much of the decline. Excluding autos and gas, sales dropped 0.5 percent, and control-group sales, which feed into GDP calculations, fell 0.8 percent, suggesting a slower start to the year for consumer spending. Notably, big-ticket purchases such as furniture and home furnishings saw a sharp pullback, likely reflecting a pause in tariff-related front-loading that had boosted demand in late 2024. Online sales also declined 1.9 percent, likely a reversion after the strong holiday shopping period, while restaurant and bar sales rose 0.9 percent, pointing to continued strength in services spending. Though retail sales data are frequently revised, the weak January print suggests that first-quarter consumer spending could slow to around 2.0 percent, down from 4.2 percent in the prior quarter.

While seasonal factors undoubtedly played a role in the consumption sag, an accumulation of data suggests that the long-anticipated consumer fatigue may finally be taking hold.

The share of outstanding US consumer debt in delinquency rose in the fourth quarter of 2024 to its highest level in nearly five years, signaling growing financial strain among households. According to the Federal Reserve Bank of New York, 3.6 percent of total consumer debt was delinquent, the highest since mid-2020, with transitions into serious delinquency increasing for auto loans, credit cards, and home equity lines of credit. Auto loans have become a particular point of stress, as higher car prices and elevated interest rates have pushed monthly payments to levels that many borrowers are struggling to afford. Credit card delinquencies also climbed, with 7.2 percent of balances transitioning into serious delinquency, matching the highest level since 2011. Meanwhile, total household debt rose 0.5 percent to a record 18 trillion dollars, with credit card balances growing the fastest at 3.9 percent in the fourth quarter, followed by increases in auto loan, student loan, and mortgage debt.

Adding to these pressures, the resumption of student loan payments in late 2024 following years of pandemic-era forbearance is expected to further contribute to delinquencies in early 2025. The New York Fed noted that millions of borrowers may already be behind on payments, though these missed payments have not yet appeared in delinquency data due to reporting lags. With interest rates remaining elevated for a third consecutive year, household financial conditions are likely to remain strained, particularly for lower-income borrowers who are disproportionately affected by rising borrowing costs. While mortgage delinquencies have remained stable, the rise in late payments across other forms of debt suggests that consumers are feeling the effects of ongoing inflation, high interest rates, and slowing wage growth, increasing the risk of further financial stress in the months ahead.

Just last month, a number of measures of economic conditions appeared poised for marked improvement, with some hesitance stemming from concerns over trade. One month later stubborn inflation, mixed employment data, and clear indications of consumer distress have contributed to a sharp reversal in sentiment among both business owners and consumers; not nearly as much, though, as the unprecedented pace of executive orders, tariff threats, and Higgsian regime uncertainty injecting debilitating layers of instability into economic decision-making. Businesses and households are edging toward the sidelines of increasingly murky business and commercial landscapes.

LEADING INDICATORS

ROUGHLY COINCIDENT INDICATORS

LAGGING INDICATORS

CAPITAL MARKET PERFORMANCE