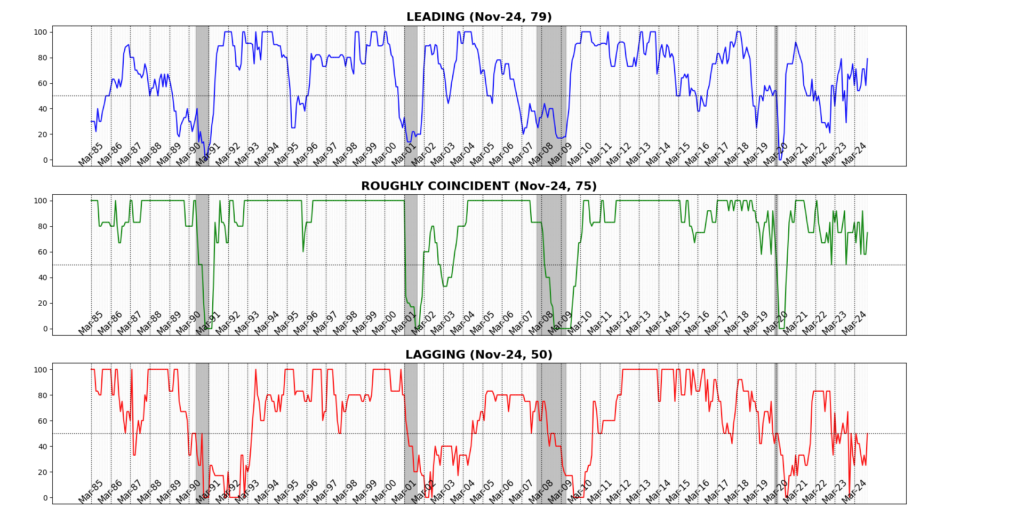

In November 2024, all three AIER Business Conditions Monthly indicators signaled a parallel shift in economic conditions. The Leading Indicator rose sharply to 79 from 58 in October, moving decisively into expansionary territory. The Roughly Coincident Indicator also increased, climbing to 75 from 58, indicating growing strength in current economic activity. Meanwhile, the Lagging Indicator rebounded from contractionary territory, rising to 50 from 25 in October, though still suggesting lingering challenges in slower-moving sectors of the economy.

Leading Indicator (79)

Of the twelve components of the Leading Indicator, seven increased, three declined, and two were unchanged in November.

The most substantial gain came from the 1-to-10 year US Treasury spread, which surged an extraordinary 1402.6 percent, reflecting a sharp steepening of the yield curve. Other notable increases included FINRA Customer Debit Balances in Margin Accounts (9.7 percent), United States Heavy Trucks Sales SAAR (6.0 percent), University of Michigan Consumer Expectations Index (3.8 percent), Conference Board US Leading Index of Stock Prices 500 Common Stocks (2.4 percent), Adjusted Retail & Food Services Sales Total SA (0.8 percent), and Conference Board US Manufacturers New Orders Nondefense Capital Good Ex Aircraft (0.4 percent).

On the downside, US Initial Jobless Claims SA dropped by 3.2 percent, followed by declines in US New Privately Owned Housing Units Started by Structure Total SAAR (-1.8 percent) and US Average Weekly Hours All Employees Manufacturing SA (0.5 percent). Two components, Inventory/Sales Ratio: Total Business and Conference Board US Leading Index Manuf New Orders Consumer Goods & Materials, remained unchanged.

Coincident Indicator (75)

The Coincident Indicator saw gains in four out of six components, while two were unchanged.

The largest increase came from the Conference Board Consumer Confidence Present Situation Index, which rose by 3.9 percent, signaling heightened optimism regarding current economic conditions. Smaller gains were recorded in Conference Board Coincident Manufacturing and Trade Sales (0.2 percent), Conference Board Coincident Personal Income Less Transfer Payments (0.2 percent), and US Employees on Nonfarm Payrolls Total SA (0.1 percent).

Both US Labor Force Participation Rate SA and US Industrial Production SA remained unchanged or declined slightly, reflecting relative stability in these components amid broader improvements.

Lagging Indicator (50)

The Lagging Indicator experienced mixed movements, with three components rising, two declining, and one unchanged.

The largest increase was observed in Conference Board US Lagging Commercial and Industrial Loans, which rose by 1.5 percent, reflecting some recovery in lending activity. This was followed by modest gains in US Manufacturing & Trade Inventories Total SA (0.1 percent).

On the other hand, the most significant decline occurred in Conference Board US Lagging Avg Duration of Unemployment (-3.5 percent), followed by a drop in US Commercial Paper Placed Top 30 Day Yield (-3.2 percent). US CPI Urban Consumers Less Food & Energy YoY NSA remained flat, and Census Bureau US Private Constructions Spending Nonresidential NSA dipped slightly by 0.02 percent, indicating muted activity in nonresidential construction.

Throughout 2024, the Leading Indicator demonstrated significant volatility, beginning the year at 67 and peaking at 75 in February. After fluctuating through midyear, it fell to 58 in September and October before rebounding strongly to 79 in November, marking a return to expansionary levels. The Roughly Coincident Indicator displayed remarkable consistency, maintaining values above 75 for much of the year, with a notable peak of 92 in August. By November, it stood at 75, reflecting continued strength in current economic activity. In contrast, the Lagging Indicator struggled to gain traction, spending most of the year below 40. While it briefly reached 50 in April, it dropped back into contractionary territory during the summer before improving again to 50 in November.

This divergence between leading and lagging indicators underscores the uneven nature of the economic recovery in 2024. The steady performance of the Roughly Coincident Indicator highlights resilience in present economic conditions, while the volatility of the Leading Indicator and the persistent weakness of lagging components point to vulnerabilities in achieving sustained momentum. While one month’s data does not constitute a trend and multiple factors are influencing the current environment, the arrival of a new administration with a proven track record of pro-business policies may have contributed to the favorable shift reflected in the November business conditions readings.

DISCUSSION

The December 2024 jobs report was strong and broadly encouraging, with nonfarm payrolls increasing by 256,000: well above the 165,000 consensus. The household survey surprised with significant employment gains and a drop in the unemployment rate, suggesting that the labor market may be stabilizing after weakening in the latter half of 2024. Gains were led by service sectors, particularly health care, retail, leisure, and professional services, while goods-producing industries shed jobs. These results bolster the Federal Reserve’s assessment that the economy remains resilient and can tolerate a pause in rate cuts. The Federal Open Market Committee (FOMC) is thus likely to maintain its current policy stance at its January 28–29 meeting.

The next payroll report, due February 7, will include benchmark revisions that may lower prior estimates for job growth, particularly for the period from April 2023 to March 2024. Revisions tied to the BLS’s “birth-and-death” model may further reduce the data for 2024, potentially confirming an overstatement of around 100,000 jobs per month. While December’s report reflects promising signs of stability in the labor market, it stops short of signaling renewed acceleration. For now, though, the labor market case for the Fed to hold rates steady as it evaluates ongoing economic conditions is supported.

The softer-than-expected core CPI report for December 2024 suggests disinflation is continuing to make progress. Core goods inflation slowed to 0.1 percent, aided by easing used car prices and slower increases in new car prices, which traditionally benefit further from favorable seasonal factors during this time of year. Core services inflation held steady at 0.3 percent, with moderate gains in primary rents and owners’ equivalent rent, while lodging costs declined. Year-over-year, rent inflation remains elevated at 4.8 percent, still above pre-pandemic norms. Other core categories, including airfares, reveal subdued price pressures. The January 15th report, coupled with favorable December PPI data, strengthens the likelihood that the upcoming core PCE deflator will align with the Federal Reserve’s 2-percent inflation target.

As with the December nonfarm payrolls release, the Fed is likely to view the December inflation data positively, reinforcing its expectation for price stability in 2025. Having said that, disinflation continues to face risks from rising energy and food prices, as well as localized disruptions like the Los Angeles wildfire; those pressures, at present, seem unlikely to derail broader inflation trends. December price data brings a sense of relief for markets, in particular the bond market, after recent volatility.

Drawing these factors together, the January Beige Book release offered an upgraded view of economic activity and employment from more tepid reports in the latter part of 2024. Economic activity expanded slightly to moderately across all 12 districts, with none reporting declines, marking a decisive improvement from prior reports. Consumer spending rose moderately, bolstered by strong holiday sales and increased spending on leisure, hospitality, and transportation, though lenders expressed concerns about delinquencies among small businesses and low-income households. Employment improved modestly, with greater demand for workers as election uncertainty eased, and layoffs remained low.

The insights align with Fed Chair Jerome Powell’s emphasis on the value of anecdotal evidence for understanding real-time economic conditions, suggesting the gap between soft and hard economic data may be narrowing. Any slimming of that gap will reduce noise, enhancing the reliability of signals and making it easier to forecast trends with greater precision. It also allows policymakers to better assess the real-time impact of policy measures, improving their ability to judge the efficacy of interventions and adjust accordingly. (It would be remiss not to comment that profound knowledge problems inherent in central planning nevertheless remain, and that experiential approaches, while helpful, do not account for the dynamic and dispersed information that drives economic activity.)

Industrial production rebounded strongly in December, driven to a large extent by a surge in aircraft production following the resolution of the Boeing strike. Aerospace manufacturing accounted for nearly one-quarter of the month’s headline growth, with overall industrial production surging 0.9 percent, far exceeding expectations. November’s figures were also revised higher, showing a 0.2 percent rise versus the originally reported decline. Durable-goods manufacturing rose 0.4 percent, although the production of consumer durables (primarily automotive products, home electronics, and appliances) fell 0.4 percent, signaling continued weakness in demand due to restrictive monetary policy. Capacity utilization climbed to 77.6 percent in December, reflective of the overall uptick in industrial activity and providing a solid benchmark for gauging the effectiveness of the incoming administration’s policies..

While December’s figures are encouraging, the outsized contribution from aircraft production diminishes its significance. Weakness in consumer durables output underscores the restrictive nature of current monetary policy, which will likely weigh on industrial output in the coming months.

Retail sales showcased resilience, particularly within control group data (which excludes volatile categories like autos and gasoline), which rose a considerable 0.7 percent. The holiday shopping season was strong, reflecting solid demand for big-ticket items such as furniture, electronics, and sporting goods, even as spending on discretionary services like dining out and entertainment softened. Headline retail sales growth (0.4 percent) was below expectations, but nonetheless supported by steady vehicle sales. That increase may represent “pull-forward” factors as consumers accelerate consumption to preempt anticipated tariff-related price increases. Rounding out the picture, a decline in building materials and garden equipment sales weighed on the overall results.

The underlying momentum in goods spending remained intact. Consumption appears poised to stay steady in the coming months, supported by favorable labor market conditions and elevated consumer sentiment. But with an expected pause in the Federal Reserve’s rate-cutting cycle, the pace of growth may moderate. Relatively tighter credit conditions could temper momentum later in the year, but as of January 2025 data underscores the near-term strength of consumer demand.

And finally: small-business sentiment surged at the end of 2024, with the National Federation of Independent Business Optimism Index climbing to a six-year high of 105.1, significantly surpassing both expectations and the prior reading of 101.7. Fueled by expectations of a more favorable operating environment under the incoming Trump administration, soft components of the index including expected business conditions, sales outlook, and expansion plans saw substantial gains. Also rising within the index were job-creation plans, capital expenditures, and earnings. The largest improvement was in expectations for economic conditions, which rose 16 points to 52 percent, signaling vaulting confidence levels. Yet while small-business enthusiasm is a promising indicator, sustained progress will depend on the realization of these anticipated policy changes and their impact on overall economic conditions.

A word now on tariffs. President Donald J. Trump’s threat to impose 25 percent tariffs on Canada and Mexico would significantly disrupt the deeply integrated North American auto industry. US automakers rely on Canada and Mexico for more than 80 percent of key auto parts, including airbags and seat belts. highlighting the sector’s dependence on cross-border supply chains. Tariffs would effectively raise costs for US manufacturers by taxing components already embedded with US value, creating a ripple effect. Half of US imports of assembled cars come from our northern and southern neighbors, meaning tariffs would reduce demand for vehicles and parts; US automakers assembling vehicles domestically would in short order face substantial headwinds.

Conversely, Canada and Mexico depend on the US for roughly 90 percent of their auto-part exports. Should tariffs be imposed, the disruption would reverberate through the broader US transport, metal, and rubber industries, as those sectors have significant value embedded in cross-border supply chains. Such tariffs risk causing widespread economic strain across North America, even before considering Canada’s threat to impose tariffs on $150 billion of US exports in response to threatened imposts.

The recent threat of 10 percent tariffs on all Chinese imports beginning February 1, atop of the aforementioned levies on Canada, Mexico, and possibly European Union imports, signals an even more aggressive stance in the aggregate. While a 10 percent tariff is far below the 60 percent floated during Trump’s campaign, it is nevertheless substantial enough to disrupt trade flows. Although ultimate impacts remain uncertain due to factors like currency adjustments, cost absorption, and China’s ability to pivot to other export markets, a broader implementation of tariffs could increase the trade-weighted average US tariff from the current 3 percent to 8 percent, distorting global supply chains. The potential for expanded tariffs above the August 2019 level could prompt Beijing to accelerate its stimulus measures to counteract economic headwinds. At the same time, high-level communication between Trump and China’s President Xi Jinping provides some hope for dialogue.

In total, economic conditions in the United States are improving and seem set for continued improvement. The disruptive potential of tariffs looms large, though, and threatens to upend the current alignment of positive factors including sharply increased business optimism, progress in disinflation, and steadying labor markets.

Leading Indicators

Roughly Coincident Indicators

Lagging Indicators

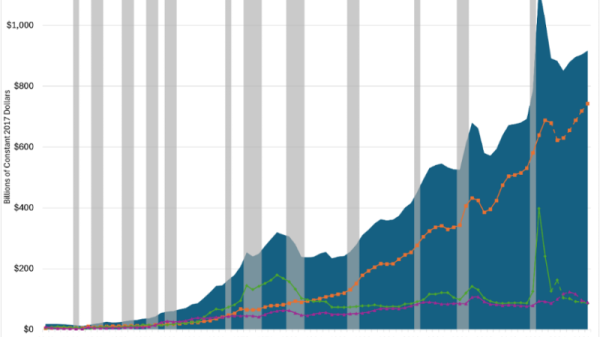

Capital Market Performance