The publishing world is awash in books about how government has failed the people by shrinking. Ruchir Sharma has given us the rare book about how government failed by growing too large and doing too much. His proposed fix is compelling and persuasive, but his book’s most valuable contribution may be simply causing readers to rethink what has become a bafflingly popular narrative about neoliberalism, austerity, and the supposed triumph of free-market ideology. One of the most common theories about the last half-century of political and economic history rests on the weakest possible foundation.

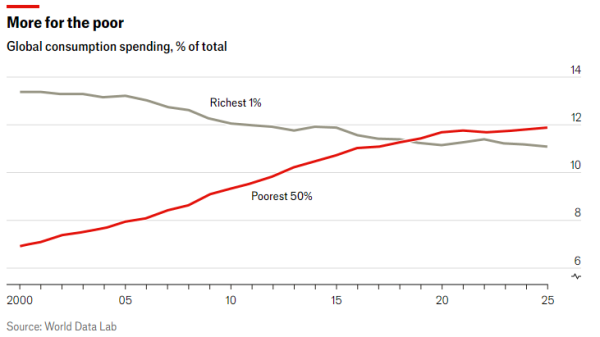

The argument Sharma takes on in What Went Wrong with Capitalism will be familiar to anyone who has read any current writing on political economy. Since the New Deal, enlightened government tax-and-spend priorities protected the poor and provided for economic mobility. The US economic expansion after World War II continued this virtuous, shared prosperity. Then, starting in the 1980s under Ronald Reagan (with parallel changes under Margaret Thatcher in the UK), market fundamentalism took hold, with government budgets for social services slashed, essential services privatized, and corporate greed turbo-charged. The result, critics charge, has been an increasingly unfair society. Income inequality has exploded and only the very rich have benefitted.

This just-so story has become received wisdom among left-leaning academics. Entire shelves of books from economics, history, and political science professors in the past couple of decades have made this case, often locating its origin in the conservative legal movement. A long list of authors has pinned the germ of this supposed revolution on pre-1980 theorizing like the legendary (or infamous) policy memo written by prominent Republican attorney (and later Supreme Court Justice) Lewis Powell in 1971. Others look to associations like the Mont Pelerin Society (co-founded by Friedrich Hayek) or think tanks like the Heritage Foundation or Cato Institute as the locus of this supposedly antisocial ideology of greed.

Journalist and Yale professor Steven Brill argues that the US has been in a “tailspin” for several decades because of these negative changes. Thomas O. McGarity of the University of Texas at Austin claims that this all has comprised a “laissez-faire revival” that has created a “freedom to harm” for corporations.

There is a lot of mutually reinforcing theory from dozens of tenured experts and their downstream fans in the pundit-industrial complex. Yet evidence that governments of the developed world, led by the United States, have withered away in the interest of allowing corporate avarice to run amok is amazingly thin.

One need only look at the budgets — and budget deficits — of the last 40-plus years. Even before the stunning explosion of deficit spending that occurred during the COVID-19 pandemic, Congress had hardly put itself on a diet. Federal outlays as a percentage of GDP were 15.9 percent in the supposed glory year of 1965, while they were 24.3 percent during the Great Recession year of 2009, before skyrocketing to almost 31 percent of the entire economy in 2020. Does that sound like miserly austerity?

The size and scope of government aren’t entirely measured by dollars spent. There is also the degree to which it regulates the conduct of private parties. This is possibly the more compelling aspect of the thesis advanced by the critics of neoliberalism: that the US government and its peers around the world have given up on attempting to police corporate behavior and tame the beast of acquisitiveness. But that angle too falls resoundingly flat. Sharma cites my own Competitive Enterprise Institute colleague Wayne Crews on this, showing that, under just the first two years of Joe Biden’s presidency, the executive branch added an annual average of $160 billion in economic costs and 110 million hours of paperwork.

Note that the Biden White House was just an acceleration of the dramatic increase in new rules and regulatory burdens that have occurred under every modern administration. Government, as Sharma writes, “has grown bigger under every president.”

So, what is actually happening? The answer is bracingly simple and in direct contrast to the academic consensus: since the 1980s — but especially in the 21st century — the federal government has spent and intervened in the economy far too much, causing a long list of distortions and problems along the way.

The technocratic meddling and stimulating and easing and soft-landing-ing has long gone unrecognized for what it is, because it has been labeled as an effort to protect the economy writ large from damage and dislocations, and thus a way to safeguard jobs and the savings of middle- and working-class households. But flooding financial markets with cheap debt has actually empowered the rich to get richer at near-zero risk while causing significant damage to the economy’s capacity for growth and innovation — the only route to actual shared prosperity.

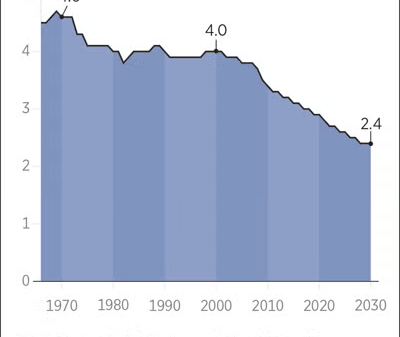

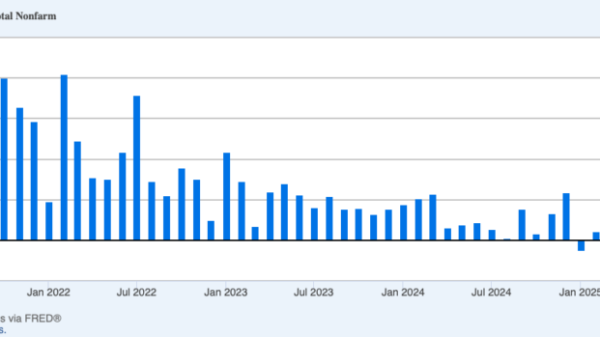

Sharma spends a lot of time castigating the Federal Reserve for keeping interest rates artificially low for such a long period of time, from roughly the Great Recession until long-term inflation fears inspired a significant rise in the Fed funds rate starting in Spring 2022. This easy money has led to the softening of capitalism’s most important process, the cycle of underperforming companies going out of business and better competitors rising from their ashes that economist Joseph Schumpeter famously called creative destruction.

With cheap debt able to prop up failing companies indefinitely, we have experienced a scenario familiar to horror movie fans — the zombie invasion. Once considered a problem of mostly Japanese economic malaise, Sharma points out that the zombie firm — one that is not generating enough revenue to cover its own debt servicing costs — has become a shambling, lurching menace across the economic landscape. If these zombies had gotten the clean shotgun blast to the head from financial reality that they deserved, their human and financial capital could have been more productively re-deployed. But instead, they hang on from year to year, lowering productivity growth and limiting credible competitive threats to the most entrenched incumbents.

On top of suppressing interest rates for extended periods of times to goose stock values and asset appreciation in general, economic policy in the US has defaulted to something like a permanent bailout mindset. If it were possible, Congress would ensure sure no major employer or lender would ever have to shut down, no matter what its balance sheet looked like.

That seems great when you, as a member of Congress or the Fed Board of Governors, assume you’re saving some specific number of jobs from vanishing in the next quarter. But it creates an obvious set of perverse incentives which simply stimulate more risk-taking by corporate management and investment firms in the future, resulting in even bigger future bailouts down the road. At a certain point this strategy of holding the wolf by the ear will become untenable. Every group of national policymakers, however, assumes that will only happen after they’ve handed the situation off to the next generation of business-cycle micromanagers.

As Sharma explains, none of this is a battle between center-left interventionists and some imaginary laissez-faire libertarians lurking in the shadows. Both major parties and politicians across the political spectrum, with a few notable exceptions, have been culpable in the process of subsidizing debt and investment risk in hopes that major stock indices will rise forever, and thus not leave anyone in power with the blame for “ruining” the economy when the music finally stops.

Back in the real world, recessions happen, and asset values sometimes fall. No economy based on reality can rise forever with zero declines along the way. Perpetual central government stimulation, even when it’s pitched as “protecting jobs,” is like a 19th century dentist giving laudanum to a patient with a toothache. The painkiller only puts off the moment of reckoning — at which time, the problem will likely be dramatically worse.

While his basic message that endless deficits and bailouts are bad policy is not novel, Sharma’s resetting of the narrative on enfeebled government is a much-needed slap in the face to mainstream conventional wisdom on economic affairs. The neoliberal conspiracy narrative has even oozed into additional crevices in recent years. It wasn’t surprising when left-leaning professor Lawrence Glickman wrote a version of this thesis up in 2019’s Free Enterprise: An American History. Now that even ostensible conservatives like Sohrab Ahmari are repeating it — in 2023’s Tyranny, Inc. — an antidote like What Went Wrong with Capitalism is sorely needed.