According to a recent Gallup poll, 62 per cent of adults in the Unites States currently own stocks, which represents the highest percentage since 2008.

While stock ownership is frequently regarded as an important component of economic participation and progress, the distribution of stock holdings tells a different tale, indicating growing wealth gaps among Americans.

The advantages of stock ownership can be enormous, allowing individuals to build their wealth over time. However, the distribution of stock ownership in the United States reveals a significant mismatch.

According to Gallup’s results, 87 per cent of people with a household income of $100,000 or more own stocks, while only 25 per cent of those with a household income of less than $30,000 do.

This gap demonstrates how wealthy people are more likely to have larger stock portfolios, compounding existing economic disparities.

Economic disparities amplified by the pandemic

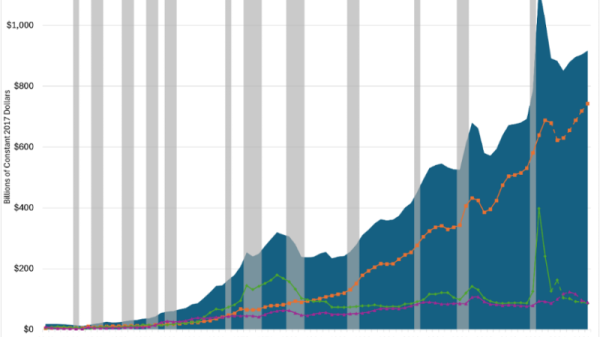

The Covid-19 outbreak exacerbated already significant inequities in stock ownership and economic accumulation.

As the pandemic struck, low-income people bore the brunt of job losses and financial instability, whereas rich persons not only kept their jobs but also profited from the subsequent stock market boom.

The rapid rise of stock prices following the initial slump during the epidemic increased the wealth of rich investors, expanding the wealth gap between them and lower-income people.

Implications for economic mobility and social cohesion

The unequal distribution of stock ownership and the resulting wealth disparity can have serious consequences for long-term economic mobility and social cohesion.

As wealthier individuals continue to increase their stock market profits, the gap between affluent and lower-income households grows, thereby impeding upward social mobility for those at the bottom of the income scale.

Furthermore, such gaps may undermine social cohesiveness by exacerbating sentiments of economic marginalization and instilling animosity in underprivileged areas.

Perception and preference in American long-term investments

While 62% of Americans own stocks, a sizable proportion still see real estate as the best long-term investment option.

According to the Gallup data, 36% of people favour real estate as a long-term investment, followed by equities or mutual funds (22%).

Gold ranks third at 18%, with savings accounts or CDs picked by 13% of respondents.

According to the survey, only 4% of participants are interested in bonds, and only 3% believe Bitcoin is a good long-term investment option.

Surprisingly, the proportion of adults who choose real estate remained unchanged compared to the previous year.

However, tastes have shifted, with more people this year picking stocks or mutual funds as their top choice and fewer naming gold as the best investment.

This year, 22% of respondents chose equities, up slightly from 26% in 2021. In contrast, gold, which had a surge in popularity last year, has retreated to more normal levels in the latest study.

Addressing the disparities

To close the growing wealth gap caused by unequal stock ownership, regulators and financial institutions must look into ways to improve financial education and access to investment possibilities for low-income people.

Creating inclusive financial literacy programs, encouraging community-based investment projects, and campaigning for progressive tax laws can all contribute to a more equal allocation of wealth in society.

While stock ownership can be an effective vehicle for wealth building and economic involvement, its unequal distribution emphasizes the critical need to address wealth inequities in the US.

Taking proactive steps to promote financial inclusion and fairness in stock ownership is critical for creating a more cohesive and equitable society in which everyone has the opportunity to benefit from economic growth and success.

The post US stock ownership disparity: 62% of Americans invested, unequal distribution raises questions appeared first on Invezz