Barrick Gold Corp (NYSE: GOLD) has outperformed market expectations with its Q2 2024 earnings, reflecting strong operational performance amidst a booming gold market.

As gold prices hover near historic highs, Barrick’s strategic initiatives and robust financials position the company to capitalize on ongoing market opportunities.

Q2 earnings in detail

In Q2 2024, Barrick reported non-GAAP earnings per share (EPS) of $0.32, surpassing analyst estimates by $0.05.

The company achieved revenues of $3.16 billion, marking an 11.7% year-over-year increase.

This growth was driven by a combination of two factors – increased gold production, and favorable market conditions.

Operating cash flow surged by 53% from the previous quarter to $1.16 billion, with free cash flow reaching $340 million.

Barrick’s strong performance can be attributed to its effective cost management and focus on high-value projects.

The company produced 948,000 ounces of gold in Q2, with all-in-sustaining costs (AISC) of $1,498 per ounce. Despite these production costs, Barrick maintained its full-year guidance, projecting gold production between 3.9 and 4.3 million ounces.

This aligns with the company’s strategy to optimize operations while expanding production capacity, notably through projects like the Goldrush mine in Nevada and the Reko Diq project in Pakistan.

Barrick is also making significant advancements in its copper business.

The Lumwana super pit expansion in Zambia and the Reko Diq project are expected to contribute substantially to Barrick’s future copper and gold outputs.

The Lumwana expansion aims to boost production from 130,000 to 240,000 tonnes annually, while Reko Diq targets 400,000 tonnes of copper and 500,000 ounces of gold per year.

These projects position Barrick to benefit from rising copper demand, adding diversification and stability to its revenue streams.

Rising gold prices: A major tailwind

The current gold market environment presents a significant opportunity for Barrick.

Gold prices have surged this year, reaching all-time highs above $2,500 per ounce.

This trend is supported by expectations of a potential interest rate cut by the Federal Reserve, which could further drive gold prices upward.

Citi analysts suggest that gold could climb to $3,000 per ounce, driven by ongoing economic uncertainties and sustained demand for safe-haven assets.

Barrick’s financial strength is evident in its Q2 results, with net earnings increasing by 25% to $370 million.

The company’s EBITDA margin also improved to 48%, underscoring its efficient cost structure.

Barrick continues to reward shareholders with a consistent quarterly dividend of $0.10 per share.

From a valuation perspective, Barrick’s forward P/E ratio of 14.28 suggests potential undervaluation compared to industry peers, which trade at a median forward P/E of 15.4.

Analysts at BofA project Barrick’s operating EPS to rise by 50% this year, reaching $1.26, with continued growth anticipated in the coming years.

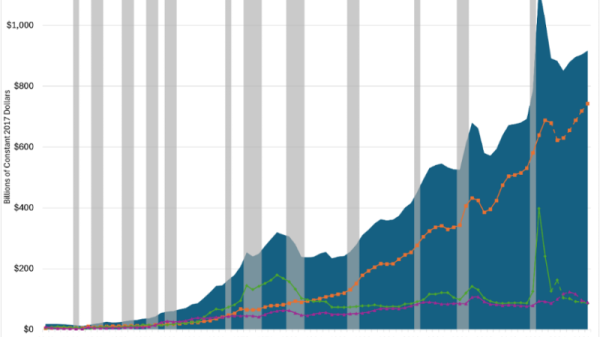

Now let’s see what the charts say about the stock’s price trajectory. The technical analysis will provide further insights into Barrick Gold’s market potential price movements, helping investors make informed decisions based on current trends and patterns in the stock’s performance.

Rangebound between $14 and $20.3

Though gold prices have shot to all-time highs, Barrick’s stock trades at a considerable discount to its all-time highs made in mid-2011. Moreover, the stock has seen an extended downturn since October 2020, when it was trading above $30.

GOLD chart by TradingView

The silver lining for bulls presently is that Since the start of 2023, Barrick’s stock has found support near the $14 level multiple times and seems to have come out of its extended downtrend having not made lower lows.

However, the stock has also found it tough to trade above the $20.3 mark for more than a year. Considering this, one shouldn’t expect the strong to make a strong move in either direction unless it breaks above the lower or higher end of this range.

Investors who are bullish on Barrick after its Q2 performance can initiate a small long position at current levels below $18, but must add to it only if the stock gives a weekly closing above $20.3

Traders who have a bearish outlook on the stock must look to short it closer to $20 with a stop loss at $20.46 and a profit target near $15.

The post Barrick Gold outperforms in Q2: Is it a buy with gold near record highs? appeared first on Invezz