Colin Huang, the founder of Temu and Pinduoduo, has recently been crowned as China’s richest man, with a net worth of $48.6 billion, according to the Bloomberg Billionaires Index.

His rise to the top marks a significant shift in China’s billionaire rankings, as he surpasses long-time titleholder Zhong Shanshan, the bottled-water magnate behind Nongfu Spring.

Huang’s wealth, which stems largely from his success in e-commerce, highlights the growing influence of digital platforms in the global economy.

The making of China’s newest tycoon

Born in 1980 in Hangzhou, Colin Huang was a teenage math prodigy who would eventually carve out a niche for himself in the tech industry.

Before founding Pinduoduo, Huang worked as an engineer at Google China, where he played a key role in expanding the company’s services in the Chinese market.

His experience at Google not only honed his technical skills but also gave him a deep understanding of the potential of e-commerce and digital platforms.

Huang’s entrepreneurial journey began with several startups, including Oku, an e-commerce platform, Xinyoudi, an online games company, and an agricultural platform, before he struck gold with Pinduoduo.

Founded in 2015, Pinduoduo quickly became one of China’s most successful e-commerce platforms, attracting consumers with its vast array of products and deeply discounted prices.

The platform’s success is largely attributed to its unique group-buying model, which allows users to team up to purchase items at lower prices, fostering a sense of community among shoppers.

Temu: The global expansion

While Pinduoduo solidified Huang’s status as a major player in China’s e-commerce scene, it was the launch of Temu in 2022 that propelled him to global prominence.

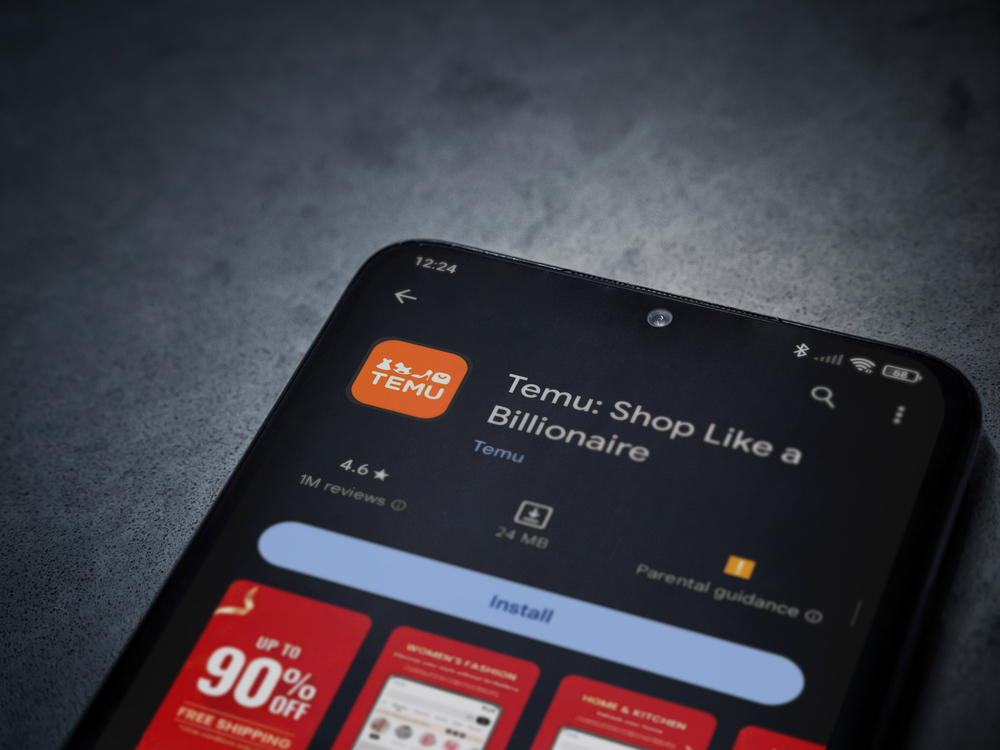

Temu, an overseas iteration of Pinduoduo, was launched in the US and rapidly gained a loyal customer base due to its ultra-low-cost goods.

The platform’s success dovetailed with the economic climate, as persistent high inflation pushed cost-conscious consumers to seek bargains.

Temu’s business model mirrors that of its parent company, offering a vast selection of products at staggeringly low prices.

The platform’s all-powerful algorithms, which optimize pricing and product recommendations, have further enhanced its appeal, making it a go-to destination for budget-conscious shoppers.

The platform’s success in the US was quickly followed by expansion into Europe, Latin America, and other regions.

Despite launching in Europe only last year, Temu has already amassed around 75 million monthly active users in the region, a testament to its rapid growth and widespread appeal.

Temu riddled with controversies

However, Temu’s meteoric rise has not been without its challenges. The platform has faced accusations of unfair commercial practices and lax safety standards. In Europe, consumer groups have alleged that Temu manipulates shoppers into spending more money, distorting their ability to make “free and informed decisions.”

These concerns have led to increased scrutiny from regulators, with South Korean authorities launching an investigation into the platform for suspected false advertising and unfair practices.

In addition to regulatory challenges, Temu has also faced backlash from merchants. In April, hundreds of merchants in China protested at an affiliated office in Guangzhou, accusing the platform of unfair treatment in the sale of their products.

These protests underscore the tensions that can arise between digital platforms and the merchants who rely on them for sales.

Despite these controversies, Temu’s success has remained largely undented. PDD Holdings, the parent company of Temu, reported a more than threefold increase in first-quarter net profit year-on-year.

The company’s US-listed shares have also performed strongly, closing at $138.02 apiece on Thursday, giving it a market capitalization of $191.68 billion.

The broader impact of Temu’s success

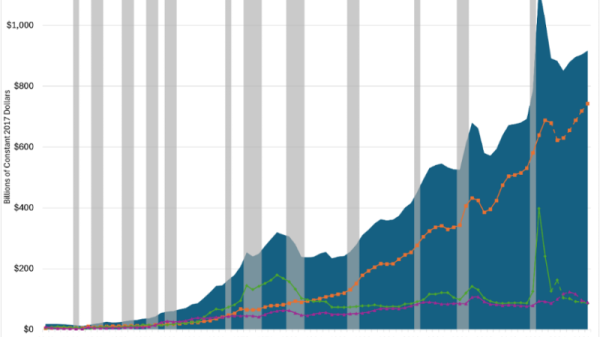

Temu’s rise reflects broader trends in the global economy, particularly the increasing influence of digital platforms in shaping consumer behaviour.

The platform’s success is a testament to the power of e-commerce to disrupt traditional retail models and capture significant market share, even in highly competitive markets like the US and Europe.

Moreover, Huang’s ascent to the top of China’s billionaire rankings highlights the shifting dynamics within the country’s business elite.

Whereas previous generations of Chinese billionaires made their fortunes in more traditional industries like manufacturing and real estate, the new wave of billionaires, including Huang, have leveraged the power of technology and e-commerce to build their empires.

This shift underscores the growing importance of the tech sector in China’s economy and its role in driving the country’s economic growth.

The future of Temu and PDD Holdings

Looking ahead, Temu and PDD Holdings face both opportunities and challenges. The platform’s rapid expansion into new markets presents significant growth opportunities, particularly as more consumers around the world turn to online shopping.

However, the company will also need to navigate the regulatory challenges that come with operating in multiple jurisdictions, as well as the ongoing tensions with merchants.

Additionally, Temu’s ability to sustain its growth will depend on its ability to maintain consumer trust and address the concerns raised by regulators and consumer groups.

This will likely require the company to invest in improving its safety standards and ensuring that its business practices are transparent and fair.

For Colin Huang, the challenge will be to continue steering the company through these challenges while maintaining its competitive edge in the global e-commerce landscape.

If he can do so, Temu and PDD Holdings are well-positioned to continue their growth trajectory and cement their status as leaders in the global e-commerce market.

The post Colin Huang: The rise of China’s new richest man and the Temu phenomenon appeared first on Invezz