California YIMBY policy director Ned Resnikoff now advocates for banning homeowners’ associations (HOAs). The YIMBY (“Yes in My Back Yard”) movement unites around the idea of building a lot more homes in the places people want to live, but it’s also philosophically divided on certain issues. Resnikoff’s position is basically “YIMBY Leninism”: force every lot to be open to dense residential development, even if doing so makes everyone worse off. YIMBYs should reject this approach, for both principled and practical reasons.

Resnikoff’s case against HOAs is simple. These private contractual communities restrict what property owners can do with their land, including building apartments. They therefore restrict the supply of housing and, by herding the wealthy together, make socioeconomic segregation worse. In his own words:

HOAs can and do use their political influence and land-use bylaws to prevent the construction of multifamily and low-cost housing in the territories they govern and the periphery. America needs millions of homes to meet demand and ease the upward pressure on housing costs, but many HOAs have rules to prevent building even small additions, such as accessory dwelling units — much less large developments like apartments. It’s difficult to estimate just how much homebuilding HOAs have thwarted in supply-constrained areas. But one thing is certain: by acting as a bulwark against new housing supply, NIMBY HOAs contribute to the housing crisis and make inequality worse.

The only problem with this argument is that his own numbers contradict his conclusion. “Nowhere are these miniature states more prevalent than in Florida,” he declares, noting that a nation-leading “close to 45 percent” of Floridians live in HOAs.

But is Florida one of the most exclusionary states for new housing? No. In fact, Florida has been one of the better states at reconciling growth and affordability. According to the latest figures from the Bureau of Economic Analysis, Florida housing costs are only 16 percent higher than the US average, not too bad for an in-demand state. Other states with lots of HOAs and reasonable housing costs include Arizona, Georgia, Nevada, and North and South Carolina.

The overwhelming conclusion of economists who have studied the matter is that public land-use rules, especially zoning, have caused housing shortages in key markets, driving up prices and rents and making some people homeless. Reforming zoning is the key to solving housing shortages, not banning HOAs.

Scholars have done a lot of research on the effects of HOAs and other private covenants on housing value, and they generally find it is positive, ranging between four and 10 percent of home value. Some evidence suggests this premium declines to zero after 25 years if covenants are not updated.

So maybe HOAs are part of the problem? Not so fast. The prior studies interpret the private covenant premium as a result of higher demand for housing subject to covenants, not lower supply. There are multiple reasons for this interpretation. First, HOAs are small. Compared to local governments, they are tiny. They cannot control the supply of housing throughout the real estate market. Second, the most credible studies compare similar homes within the same real estate market. That means buyers can choose whether to buy inside or outside an HOA. An HOA price premium suggests higher buyer demand for HOA properties.

Of course, not everyone wants to live in an HOA. And HOAs can do plenty of unreasonable things. They can even lose their value as time goes by, which is why state laws should let private covenants lapse unless the owners agree to renew them. Local zoning codes forcing new developments into HOAs, as many do, is a bad idea. But since HOAs are so small and varied, there’s a simple solution for anyone who doesn’t like them: don’t live in one.

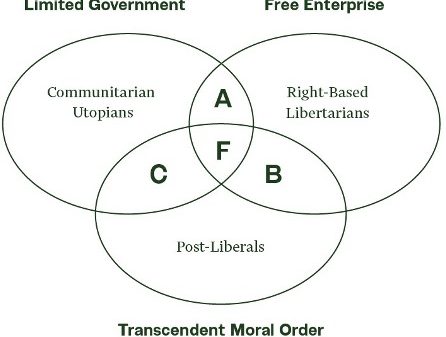

“We may need to break the system of privatized governance entirely,” says Resnikoff. But why take away an option that some people value? Some people truly do not want to live in densely developed neighborhoods. Some people truly value restrictive land-use governance. They should be able to impose these strict rules on themselves, so long as they leave their non-consenting neighbors alone.

Resnikoff also criticizes states like New Jersey and Texas that let HOA members get a credit on property taxes for HOA dues they pay toward infrastructure like roads. But isn’t it unfair to charge HOA members twice for the benefits that their non-HOA neighbors pay for only once?

Instead of taking away HOA self-governance, we should broaden access to private governance. What if we let any master-planned community have the same tax benefits that HOAs have, and also exempt them from local zoning? Then people could form private communities that have less strict land-use governance than the surrounding municipality.

Developers would champ at the bit for the opportunity to develop master-planned multifamily and mixed-use communities that wouldn’t have to follow restrictive municipal zoning procedures and rules. Private land-use governance could be a tool for unleashing housing supply!

Banning HOAs and other private covenants and forcing density on everyone is also a bad political move for YIMBYs. As Nolan Gray has detailed, city enforcement of private covenants was a key part of the political deal that stopped zoning in Houston, allowing the city to remain America’s most affordable large city that is also fast-growing. If you take away private covenants, you raise the demand for strict public land-use regulation.

YIMBYs have rightly scoffed at NIMBY misinformation that claims that ending single-family zoning means ending single-family neighborhoods. “No one is going to take away your single-family home,” we have said. But “YIMBY Leninism” that abrogates voluntary covenants and forces people to accept development that their neighbors have previously agreed not to undertake risks sparking a backlash. YIMBYs should keep our eye on the ball: reforming state and local land-use regulation to make it easier and cheaper to build lots of new homes.