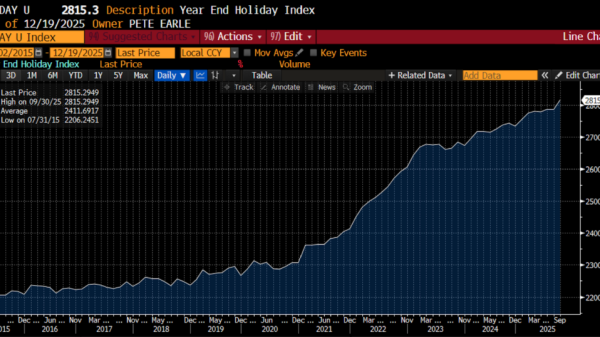

With America’s debt projected to reach astronomical levels in the next decade, my generation will need to step up to the plate and overcome our chronic spending addiction. Recent projections by the Congressional Budget Office (CBO) forecast that by 2034, total deficit spending will climb to $2.6 trillion, amounting to 116 percent of GDP. But as Mark J. Warshawsky of the American Enterprise Institute notes, these projections could be vastly understated.

Indeed, with a few tweaks to the model — including adding realistic deficit growth and real interest rate figures — Warshawsky finds that by 2034, debt-to-GDP could be as high as 138 percent. While the US dollar remains strong despite our fiscal woes, our luck isn’t guaranteed. And if we continue down our current fiscal path, we will reach a cliff over which our economy and society will be unable to reverse course.

Which brings me to my main point: my generation (Gen Z, age 12–27) is ill-equipped to confront our looming fiscal crisis. My generation is buried in student loans. We accrue mountains of personal debt, opening up new lines of credit and eschewing financial responsibility. Making matters worse, Generation Z has fully leaned into gambling, with the hopes of getting rich quick. Sports betting, options trading, and other risky activities are the new normal for young adults who are fed up with inflation, high housing costs, and a government that believes that the conventional rules don’t apply to them.

An emerging trend encapsulates the growing dissatisfaction my generation feels toward its economic prospects. Personal finance expert Dave Ramsey has preached financial prudence for decades, extolling the virtues of saving money and tightening belts. But this message isn’t resonating with Gen Zers, who frequently criticize Ramsey for his “out-of-touch” advice. Why save and invest now when any realistic shot at homeownership is 20, perhaps 30 years away? Why minimize household spending when inflation shrinks our wallets anyway? Advice that once guided previous generations toward prudent financial decisions has morphed into silly memes that my generation can barely take seriously.

Responding to Ramsey’s frequent advice to young people to slash their spending, one TikTok streamer told the Wall Street Journal, “I’m sorry, I’m not willing to do anything to get out of debt. I’m not willing to eat rice and beans every day.” Another young critic of Ramsey cites his apparent indifference to young adults whose personal finances are tight. While some of these criticisms are understandable, the flood of backlash against “boomer” financial advice suggests that young Americans are unprepared to fix our country’s debt given that we can’t get our own, individual financial houses in order.

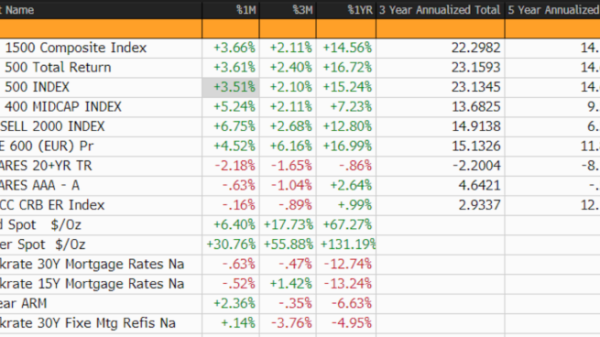

Despite record high wages and a steady labor market, Gen Zers still feel like the American Dream is more unattainable than ever. The cost of living is the main reason why. According to Bureau of Labor Statistics data, analyzed by the Washington Post, Gen Z Americans are spending 31 percent more on housing and 46 percent more on health insurance than Millennials (age 28–43) did just a decade ago.

Of course, whenever we examine data that gauge the pulse of American satisfaction, we must look at both sides of the coin. For example, Gallup poll data indicates that roughly 30 percent of US adults view the American Dream is unattainable, but that means that 70 percent view it as within reach. We can celebrate the incredible strides of economic progress while also addressing the concerns that young Americans feel when the fruits of that progress seem distant.

But our sympathies will only get us so far. My generation needs to get their act together. They need to take responsibility, even if that means following “outdated” financial advice that requires self-discipline. It could be argued that because previous generations have ushered in the financial mess America now faces, sinking deeper into personal debt would not substantially change the country’s chances of fiscal ruin. But I believe that our dismal debt history implies the exact opposite: my generation has a responsibility to act prudently because the stakes are so high and because it will be my generation who will be called upon to right our teetering economy when the time comes.

America’s unsustainable deficit spending doesn’t just spell future economic ruin. It also dampens current economic growth. One paper reports that 36 out of 40 studies find an overwhelmingly negative relationship between countries with high debt and economic growth, as economic theory would predict. This means that not only are Gen Z Americans unprepared to reform our country’s spending programs and revive the nation’s fiscal health, they are also engaging in the very behavior that will undermine their ability to achieve the American Dream. By embracing financial nihilism, they thwart any realistic chance at solving the problems that they claim to be protesting.

The fiscal cliff is approaching faster than expected. My generation needs to get its house in order before it can steer our country’s finances toward solvency. Our nation’s health — and our livelihoods — depend on it.