The Biden Administration just released a plan to cap rent increases at 5% for apartments owned by anyone who owns 50 or more apartments. The administration claims the policy would cover more than 20 million apartments, or about half of the total number of apartments in the country. New construction and “substantial rehabilitation or renovation” would be exempt. The policy would also expire after two years.

Economists almost unanimously oppose rent control, and for good reason. Capping rents punishes housing providers, making them less likely to build new housing. Exempting new construction doesn’t help much, because housing providers will still have an incentive to skimp on maintenance of the controlled units or convert them to condos for sale. Rents are set by supply and demand in a competitive market. The only desirable way to bring down rents for everyone is to make it cheaper and easier to build new housing, to increase supply.

Studies of rent control show that it hurts not just housing providers, but tenants as well. A study of 1996 New York data in the prestigious Journal of Urban Economics found that rents rose in the uncontrolled sector after rent control was extended, harming those tenants. But even tenants living in rent-controlled buildings were worse off, because they found it difficult to move to apartments that better fit their needs (a more appropriate size, closer to work, etc.). The total welfare losses to tenants per year were two and a half billion dollars in 1996 dollars, or $4.4 billion in today’s dollars. Nationwide, based on multiple studies of existing policies in the U.S., I estimate that the combined losses to tenants and housing providers of a typical rent control policy would be over $50 billion per year. Moreover, this study didn’t even try to estimate the welfare losses caused by poor maintenance of rent-controlled apartments.

Of course, that’s just one study. But the most recent, comprehensive, peer-reviewed survey of all the evidence on rent control concludes that “nearly all studies indicate a negative effect of rent control on mobility.” Additionally, “published studies are almost unanimous…that rent control leads to a deterioration in the quality of those dwellings subject to regulations.” Two-thirds of studies show a negative impact on supply.

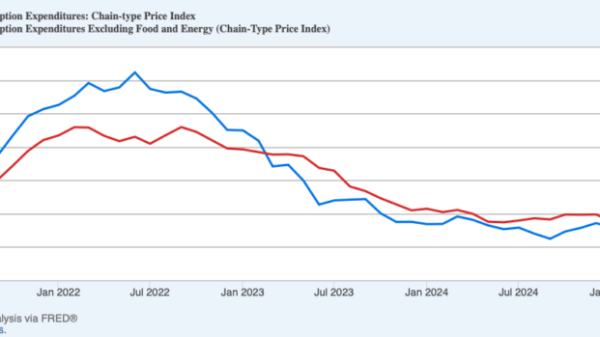

The Biden Administration’s justification of the policy doesn’t even make sense on their own terms. They point to growing profits for six publicly traded apartment companies. But the very financial reports they rely on for this data point show that for these companies, average rents increased over the last year only between 1.8 and 3.4%, either at or below the general rate of inflation. Their profits grew mostly through higher interest and asset management income, not higher rents.

Unfortunately, there is a very real risk the policy will be enacted into law after the election. That’s because rent control would be tied to a provision in the tax code allowing accelerated depreciation of residential rental property. Housing providers who don’t cap rents will therefore see a higher tax rate.

Because rent control will become part of the tax code, Democrats will be able to use the budget reconciliation process to enact it into law. That allows them to skirt the filibuster, so long as they have control of both houses of Congress. Now, Democratic economists oppose rent control, and some Democratic lawmakers might too, but with both parties dusting off quack economic policies from the 1930s, this counterproductive measure could pass the next Congress.

Instead of a damaging nationwide rent control law, the Biden Administration should focus on what the federal government can do to increase housing supply. Fortunately, the administration is trying to repurpose federal lands for building housing, but they want to attach lots of regulatory red tape to what kinds of units can be built through this program. Also, outside Nevada, not much federal land is close to where the jobs are. They’re also shoveling more subsidies out the door, but direct subsidies for housing construction are expensive. Only about 10,000 units are expected to be built with the subsidies, a drop in the bucket.

As long as the federal government is handing out money, they could make a bigger impact by helping localities expand water and sewer systems, expanding the area suitable for dense residential development on the edges of where such development already exists. (Sewer expansion also helps the environment!)

Even better, the administration could repeal tariffs on Canadian lumber, encourage states to ease occupational licensing restrictions on construction trades, cut back on demand subsidies that drive up prices, condition transportation funding on local zoning reform, and stop pushing energy code adoption. These measures could have a real impact on housing construction.

Rent control is a terrible idea that belongs in the dustbin of history. Let’s hope Congress gets the memo.